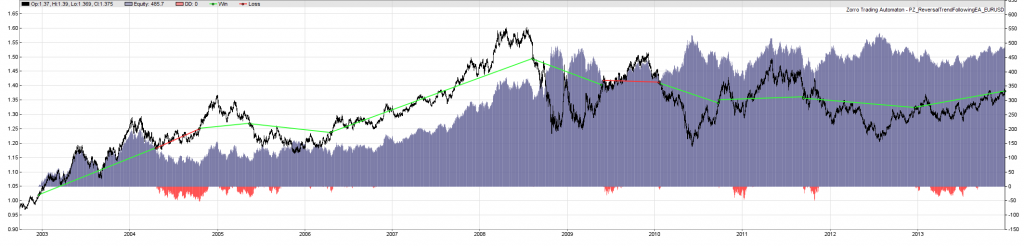

So I this is the zorro translation I came up with. Took me a little while to realise I had to compare the current price close to the previous highest in the last 100 based on the way the code is set. Learning with each day. The system seems to perform well in trending markets but not post 2008.

function run()

{

set(TICKS);

StartDate = 2002;

EndDate = 2013;

BarPeriod = 1440;

LookBack = 200;

//edge trading logic

vars rHigh = series(HH(100));

vars rLow = series(LL(100));

vars Price = series(price());

vars PriceClose = series(priceClose());

vars PriceHigh = series(priceHigh());

vars PriceLow = series(priceLow());

// Pending buy order placed at the previous day High.

if(PriceClose[0]>rHigh[1] && NumOpenLong == 0){

exitShort();

Entry = PriceHigh[0];

enterLong();

}

// Pending sell order placed at the previous day High.

else if(PriceClose[0]<rLow[1]& NumOpenShort == 0){

exitLong();

Entry = PriceLow[0];

enterShort();

}

}

BackTest: PZ_ReversalTrendFollowingEA EUR/USD 2002..2013

Profit 490$ MI 4$ DD 52$ Capital 32$

Trades 11 Win 82% Avg +585.9p Bars 259

AR 136% PF 9.79 SR 0.41 UI 14.5% Error 151%

Another one to file under potential.