Posted By: dusktrader

Monte Carlo analysis seems amazing - 04/25/14 14:28

This feature is amazing. It's so simple and fast that it seems too good to be true.

Can you please answer a few questions I have so far:

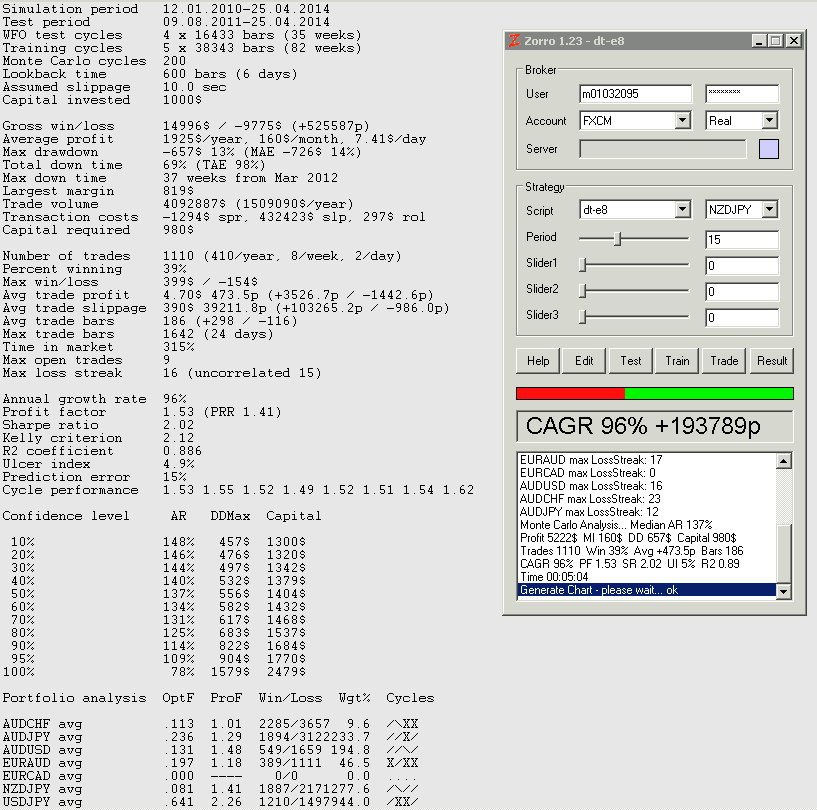

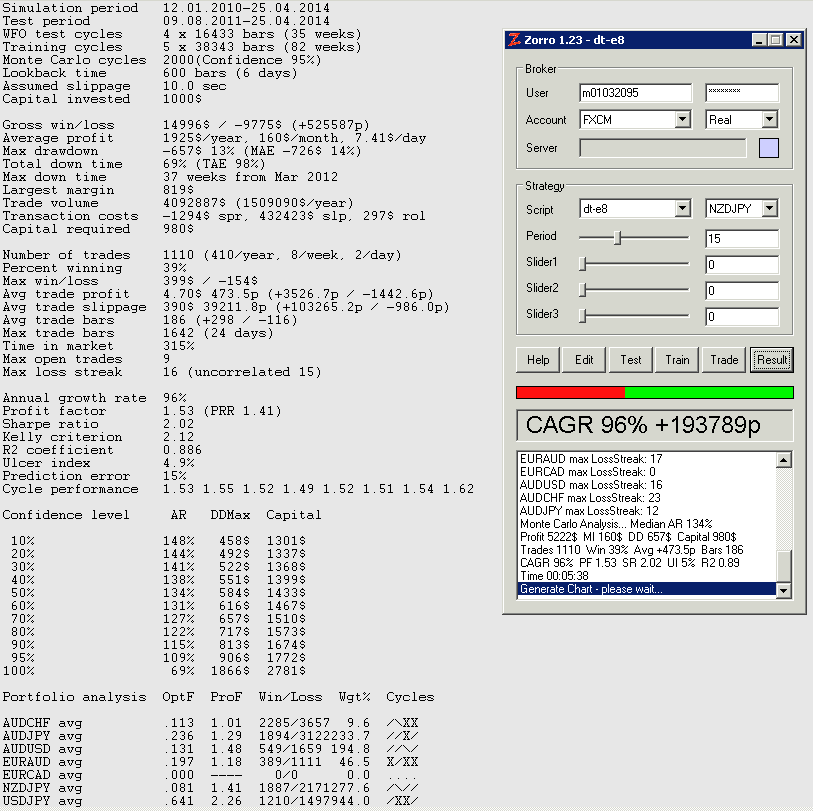

I see that the simulations are random. Is it possible then that there could be a situation where the reported values could change between tests? I would think this is a Yes, but possibly only noticeable if the # of simulations were very small. For example I have my # of simulations set very high at 2000. It seems that, in a given random sampling, the outcome would tend towards the same result as the # of simulations increase. And this would then be reflective of the real-world expected performance of the trade logic.

Where is the Median AR% figure coming from? That number doesn't seem to change if I increase the # of simulations. I don't think that comes from the 50% confidence level. What is the usefulness of knowing the Median AR% figure? Personally I want to look at the most realistic outcome, about 95%

THANKS

Can you please answer a few questions I have so far:

I see that the simulations are random. Is it possible then that there could be a situation where the reported values could change between tests? I would think this is a Yes, but possibly only noticeable if the # of simulations were very small. For example I have my # of simulations set very high at 2000. It seems that, in a given random sampling, the outcome would tend towards the same result as the # of simulations increase. And this would then be reflective of the real-world expected performance of the trade logic.

Where is the Median AR% figure coming from? That number doesn't seem to change if I increase the # of simulations. I don't think that comes from the 50% confidence level. What is the usefulness of knowing the Median AR% figure? Personally I want to look at the most realistic outcome, about 95%

THANKS