Thank you for your answer. I set the Slippage to 0 and the results are still the same as before. In Zorro 1.50.6 I got AR 2% - SR 0.05 and in Zorro 1.54.5 I got AR 33% - SR 0.46. Which are the good and reliable results? Those made in Zorro 1.50.6 or those made in Zorro 1.54.5?

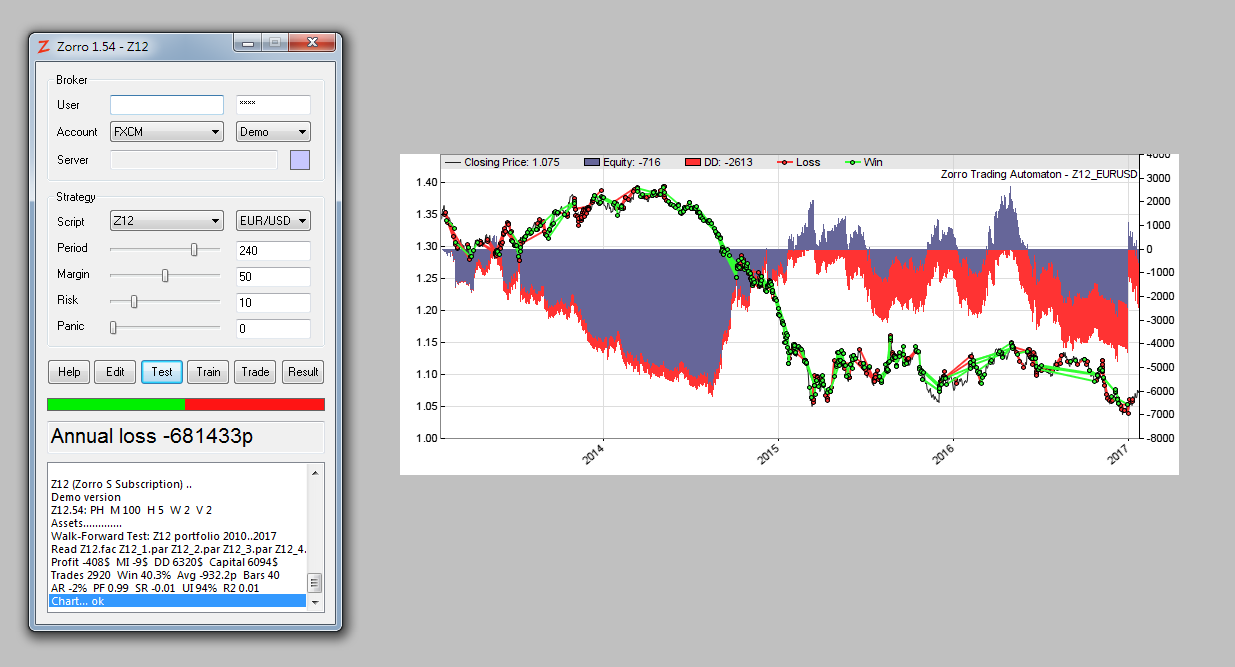

I attach the script and results.

Thank you very much.

-----------------------------------------------------------

function run()

{

BarPeriod=60;

Slippage = 0;

vars Price = series(price());

vars Trend = series(LowPass(Price,500));

vars Signals = series(0);

Stop = 4*ATR(100);

vars MMI_Raw = series(MMI(Price,300));

vars MMI_Smooth = series(LowPass(MMI_Raw,500));

if(falling(MMI_Smooth)) {

if(valley(Trend))

enterLong();

else if(peak(Trend))

enterShort();

}

}

***********************************

Test 1-PRU EUR/USD - ZORRO 1.50.6

***********************************

Simulated account AssetsFix

Bar period 1 hour (avg 92 min)

Test period 18.01.2012-27.01.2017 (28550 bars)

Lookback period 300 bars (18 days)

Monte Carlo cycles 200

Simulation mode Realistic (slippage 0.0 sec)

Spread 0.5 pips (roll -0.02/0.01)

Commission 0.60

Contracts per lot 1000.0

Gross win/loss 597$ / -576$ (+246p)

Average profit 4.26$/year, 0.36$/month, 0.02$/day

Max drawdown -205$ 958% (MAE -248$ 1159%)

Total down time 73% (TAE 60%)

Max down time 66 weeks from Apr 2013

Max open margin 30$

Max open risk 24$

Trade volume 201115$ (40010$/year)

Transaction costs -8.19$ spr, -50$ slp, -0.45$ rol, -11$ com

Capital required 188$

Number of trades 188 (38/year, 1/week, 1/day)

Percent winning 18.6%

Max win/loss 88$ / -53$

Avg trade profit 0.11$ 1.3p (+196.0p / -43.2p)

Avg trade slippage -0.27$ -3.1p (+0.0p / -3.8p)

Avg trade bars 105 (+399 / -37)

Max trade bars 1372 (11 weeks)

Time in market 69%

Max open trades 3

Max loss streak 16 (uncorrelated 28)

Annual return 2%

Profit factor 1.04 (PRR 0.80)

Sharpe ratio 0.05

Kelly criterion 0.09

R2 coefficient 0.000

Ulcer index 33.9%

Confidence level AR DDMax Capital

10% 5% 78$ 90$

20% 4% 87$ 97$

30% 4% 100$ 107$

40% 4% 109$ 114$

50% 3% 120$ 122$

60% 3% 134$ 133$

70% 3% 147$ 144$

80% 3% 167$ 159$

90% 2% 194$ 180$

95% 2% 229$ 207$

100% 1% 368$ 314$

Portfolio analysis OptF ProF Win/Loss Wgt%

EUR/USD .007 1.04 35/153 100.0

EUR/USD:L .000 0.48 13/86 -873.3

EUR/USD:S .190 1.98 22/67 973.3

*************************************************************

Test 2-PRU EUR/USD - ZORRO 1.54.5

*************************************************************

Simulated account AssetsFix

Bar period 1 hour (avg 92 min)

Test period 18.01.2012-27.01.2017 (28549 bars)

Lookback period 300 bars (18 days)

Monte Carlo cycles 200

Simulation mode Realistic (slippage 0.0 sec)

Spread 0.5 pips (roll -0.02/0.01)

Commission 0.60

Contracts per lot 1000.0

Gross win/loss 749$ / -520$ (+2632p)

Average profit 46$/year, 3.80$/month, 0.18$/day

Max drawdown -129$ 56% (MAE -160$ 70%)

Total down time 72% (TAE 65%)

Max down time 93 weeks from May 2013

Max open margin 40$

Max open risk 26$

Trade volume 210101$ (41798$/year)

Transaction costs -8.54$ spr, 0.00$ slp, -0.49$ rol, -12$ com

Capital required 139$

Number of trades 196 (39/year, 1/week, 1/day)

Percent winning 20.9%

Max win/loss 88$ / -11$

Avg trade profit 1.17$ 13.4p (+209.8p / -38.5p)

Avg trade slippage 0.00$ 0.0p (+0.0p / -0.0p)

Avg trade bars 114 (+414 / -35)

Max trade bars 1366 (11 weeks)

Time in market 79%

Max open trades 4

Max loss streak 16 (uncorrelated 25)

Annual return 33%

Profit factor 1.44 (PRR 1.13)

Sharpe ratio 0.46

Kelly criterion 0.66

R2 coefficient 0.000

Ulcer index 18.0%

Confidence level AR DDMax Capital

10% 45% 78$ 100$

20% 43% 87$ 107$

30% 41% 93$ 112$

40% 38% 102$ 119$

50% 37% 109$ 124$

60% 35% 119$ 132$

70% 33% 129$ 140$

80% 29% 150$ 156$

90% 25% 180$ 179$

95% 24% 198$ 193$

100% 14% 375$ 329$

Portfolio analysis OptF ProF Win/Loss Wgt%

EUR/USD .091 1.44 41/155 100.0

EUR/USD:L .000 0.98 19/80 -2.1

EUR/USD:S .187 2.01 22/75 102.1