Posted By: tradingest

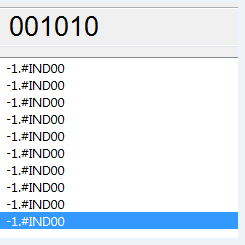

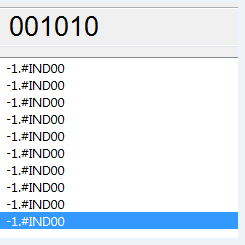

Correlation -1.#IND00 - 01/18/19 13:57

Hi guys,

why using the code below I see this message?

why using the code below I see this message?

Code:

vars serie1, serie2, serie3;

function run(){

StartDate = 2013;

EndDate = 2018;

LookBack = 0;

BarPeriod = 1;

assetList("Assets");

asset("GBP/USD");

serie2 = series(priceClose());

asset("EUR/USD");

serie3 = series(priceClose());

printf("n %f", Correlation(serie2, serie3, 240));

}