Posted By: tomna1993

Backtest accuracy - 05/07/21 17:29

Hi all,

I'm trying to backtest one signal just to get an information about accuracy of backtesting. For that I use 1 year of MNQ data, the bars in dataset have 1 second bar period (the dataset is in t6 format).

I ran two tests. In the first one I entered the trades in the run function, in the second I used tick function to enter the trades. As I understand from manual, when I have 1sec data and I use 1 minute bar period there will be 60 ticks, so Zorro will step into tick function 60 times during the completion of the run function. (I hope I didn't misunderstood that, please correct me if yes )

)

The test is about place a trade with 10000USD, set up the Stop to -1R and the TP to +1R and check in the log how much of the trades are wrong. Wrong trades means they are out from the +9900 -> +10100 or -9900 -> -10100 zones.

1.4% of the trades are wrong In tests where I enter the trades in run function.

In case of using the tick function I get 13% wrong trades.

Am I missing something? I think this should be otherwise, when I use just the 1 minute bars (when enter trades in run function) I should get worst accuracy then with the tick function.

Does someone have statistics about the accuracy, and can give me a hint how can I reach the highest accuracy with tick mode?

Thank you!

Below you can see my code:

I'm trying to backtest one signal just to get an information about accuracy of backtesting. For that I use 1 year of MNQ data, the bars in dataset have 1 second bar period (the dataset is in t6 format).

I ran two tests. In the first one I entered the trades in the run function, in the second I used tick function to enter the trades. As I understand from manual, when I have 1sec data and I use 1 minute bar period there will be 60 ticks, so Zorro will step into tick function 60 times during the completion of the run function. (I hope I didn't misunderstood that, please correct me if yes

The test is about place a trade with 10000USD, set up the Stop to -1R and the TP to +1R and check in the log how much of the trades are wrong. Wrong trades means they are out from the +9900 -> +10100 or -9900 -> -10100 zones.

1.4% of the trades are wrong In tests where I enter the trades in run function.

In case of using the tick function I get 13% wrong trades.

Am I missing something? I think this should be otherwise, when I use just the 1 minute bars (when enter trades in run function) I should get worst accuracy then with the tick function.

Does someone have statistics about the accuracy, and can give me a hint how can I reach the highest accuracy with tick mode?

Thank you!

Below you can see my code:

Code

#include <profile.c>

vars Open, High, Low, Close, BarHeight;

var SignalEntry, SignalStop, SignalTakeprofit, Contract;

bool signal;

static var Time = 0;

function tick()

{

if(signal && !(TradeIsOpen))

{

enterLong((int)Contract,SignalEntry,SignalStop,SignalTakeprofit);

signal = false;

}

}

function run()

{

set(PLOTNOW);

if(is(INITRUN))

{

set(LOGFILE);

set(TICKS); // comment out when enter trade in run function

Time = timer();

StartDate = 20200101;

EndDate = 20201231;

StartMarket = 1330;

EndMarket = 2000;

setf(BarMode, BR_LEISURE);

signal = false;

PlotScale = 8;

LookBack = 100;

ColorUp = 0x00BC0A;

ColorDn = 0xDE0505;

Slippage = 0;

Spread = 0;

PIP = 25./1;

PIPCost = 50./1;

BarPeriod = 1; //use 1min bars to test, get around 7000 signals in a year

asset("MNQ_2020_1sec");

}

Open = series(priceOpen());

High = series(priceHigh());

Low = series(priceLow());

Close = series(priceClose());

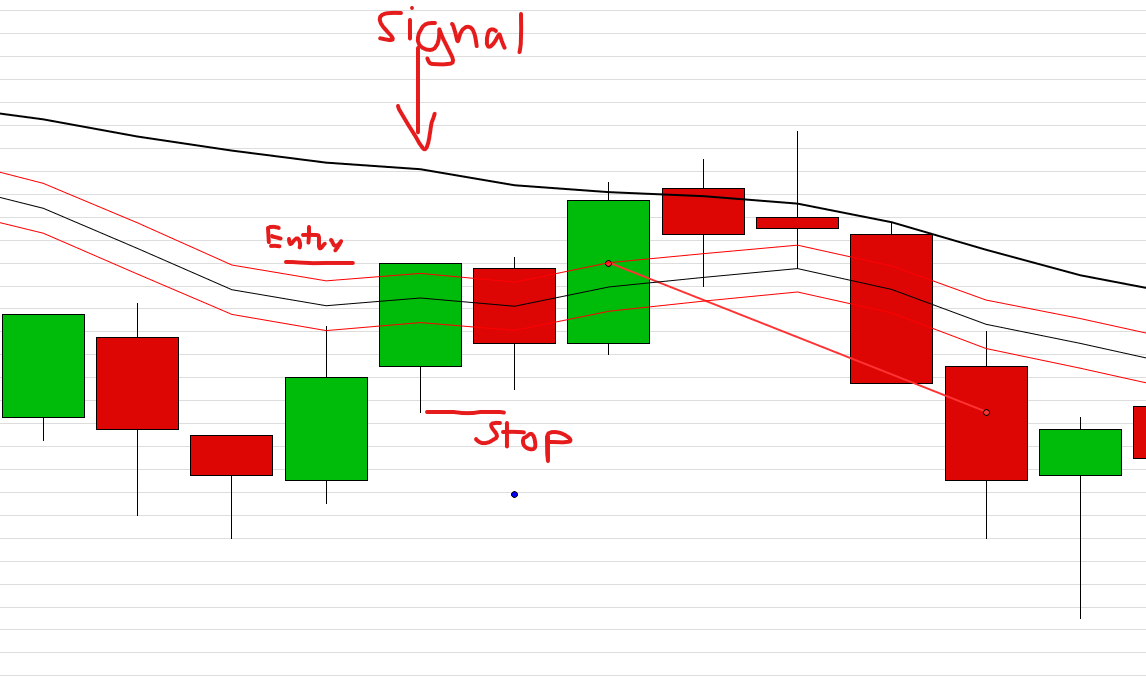

if (LongSignal)

{

plot("Bull k", (Low[0] - ATR10[0]*0.5), DOT|MAIN, BLUE);

SignalEntry = High[0]; // enter the trade on level of signal High

SignalStop = Low[0]; // stop on Low of the signal bar, ST is -1R

SignalTakeprofit = High[0] + BarHeight[0]; // add the signal bar height to the signal bar, TP is +1R

Contract = 10000/((SignalEntry - SignalStop)*2); // calculate enough contracts to get the best accuracy

signal = true; // used when backtest with tick function

//enterLong((int)Contract,SignalEntry,SignalStop,SignalTakeprofit); // comment out when enter trade in tick function

}

if (is(EXITRUN))

{

printf("\nTime needed: >>> %.3f sec <<<",(timer()-Time)/1000); // print time needed to complete the test

}

}