Z12 trade

Posted By: Sundance

Z12 trade - 08/01/13 13:18

Wow. Z12 did open a long trade on AUDUSD.

Since the beginning of april AUDUSD is in a downtrend. I can't see any priceaction which explains a buy. Really interesting...

Z12 seems to think that something indicates the end of the downtrend...

or a mean reversion / correction in the downtrend?

what algo did it?

it is likely to be a z2 algo counter trend similar to the High pass in workshop 5. BB from z2 sounds suspiciously like bollinger bands, they'll have been giving plenty of buy signals in that downtrend I'll bet!!

Posted By: Sundance

Re: Z12 trade - 08/01/13 15:20

Could be. Nice thoughts. Will see where it ends. Looks like countertrend but the price was going very far into the wrong direction. I really wanted to know where the take profit of that trade is!

Posted By: Sundance

Re: Z12 trade - 08/01/13 16:40

Trade hit its StopLoss by 51pips. Can't all be winners. Till now only bad trades since re-starting Z12 on the FXCM account. Time will tell...

Posted By: Anonymous

Re: Z12 trade - 08/01/13 18:26

Trade hit its StopLoss by 51pips. Can't all be winners. Till now only bad trades since re-starting Z12 on the FXCM account. Time will tell...

Checkout Z12 on my demo. Over €1400 in profit right now! Of 9 open trades, 8 winning, only one losing. Unrealized profit, of course. We'll see what happens. Many trades have been open days ago, so your recently started Z12 is unfortunately too young to have them.

When it's this deep in profit, makes one wonder, why oh why it's not a REAL account?

And the other question, if it was a real account, would I close all trades RIGHT NOW.

I suppose, bad habit of biting nails could actually be useful for traders.

Posted By: Sundance

Re: Z12 trade - 08/01/13 19:19

I agree. It is essential when to start Z12. I've started a second account it it took one trade in the opposite direction. So i think in the long run Z12 will do it right. What else. Beach is waiting....

As we said earlier. Lets wait till December. Then we will go live the big way :-)

Posted By: Anonymous

Re: Z12 trade - 08/01/13 19:24

I agree. It is essential when to start Z12. I've started a second account it it took one trade in the opposite direction. So i think in the long run Z12 will do it right. What else. Beach is waiting....

As we said earlier. Lets wait till December. Then we will go live the big way :-)

If that means that we'll be on the beach in January, then I'll start looking for the beaches on the *southern* hemisphere.

Posted By: Sundance

Re: Z12 trade - 08/01/13 19:27

Oh. You are right. Haven't thought about the climate in January. Next beach from Bonn is in Netherlands. Bbbrrrr. Better go south. Yepp.

Posted By: Sundance

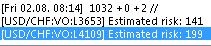

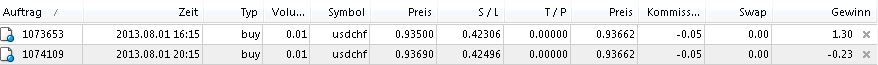

Re: Z12 trade - 08/02/13 09:05

Now i see something i can't understand.

Z12 did took two BUY USDCHF today. The current price is around 0.938$ .

The trades hav a SL of ~0.424. Till today i expected this should be some emergency SL if Zorro lost the control over the trades. A SL of 0.424$ doesn't make any sense. This is so far away from the current price. When dropping to this SL i think its to late ...

Has this SL a deeper meaning?

Posted By: jcl

Re: Z12 trade - 08/02/13 09:24

I can not confirm that Z12 bought USDCHF today. I only see a USDCHF sell today from Z12, and with a normal stop.

Posted By: Sundance

Re: Z12 trade - 08/02/13 09:29

Hi JCL. Attached you see that it took the trades...

Posted By: Sundance

Re: Z12 trade - 08/02/13 09:31

The funny thing is that the both Z12 accounts took the trades in different directions... One short the other long ...

Just look at my signature. There you see the two MT4i info pages... The Z12 instances started not the same time. So at the moment i think its just because of the initial situation which can cause such a behaviour. You stated that it is possible that Z12 starts with some loosing trades...

Posted By: jcl

Re: Z12 trade - 08/02/13 09:53

No, that message was not for opening a trade. The trades had already been opened yesterday. "Estimated risk" is a trailing message from the strategy, opening a trade gives a "Short" or "Long" message.

It's normal that the system opens a long trade one day and then opens a short trade of the same instrument with a different algo the next day. Due to the random element, some systems might not execute the long and others not the short trade. However the S/L distance in MT4 is indeed quite high, we'll check what could be the reason for that.

Posted By: Sundance

Re: Z12 trade - 08/02/13 10:11

Thanks for checking. As i stated above i'am not concerned about the trades :-)

Posted By: bfleming

Re: Z12 trade - 08/07/13 08:53

I've been running Z12 on a demo account since July 18 and so far, yes, it's doing well. It's booked $1,064 in profit with another $835 floating. Will wait some months before I go live as well

I'd like to post the results on Myfxbook or such to share with you guys, but I'm running it on FXCM TS2, and for some reason when I try to run Myfxbook's publisher (in administrator mode, as they instruct, because I'm using Windows 7 - in fact, am running Windows 7 via Parallels on a Mac), I get a network error that says: "Windows cannot access \\psf\Home\Downloads\TradingStationPublisher.exe Check the spelling of the name. Otherwise there might be a problem with your network." I've asked Myfxbook support about this, but they have no idea and told me it shouldn't have anything to do with the network.

Anyone have a solution for this, or some other way to share my results?

BTW, Sundance, my Z12 didn't take any USDCHF trades, but when it does open trades, it places huge SLs. These haven't been hit yet, but trades have been closed at a loss, so I'm assuming the SL is some sort of emergency stop. Is this right?

Posted By: Anonymous

Re: Z12 trade - 08/07/13 09:03

I'd like to post the results on Myfxbook or such to share with you guys, but I'm running it on FXCM TS2, and for some reason when I try to run Myfxbook's publisher (in administrator mode, as they instruct, because I'm using Windows 7 - in fact, am running Windows 7 via Parallels on a Mac), I get a network error that says: "Windows cannot access \\psf\Home\Downloads\TradingStationPublisher.exe Check the spelling of the name. Otherwise there might be a problem with your network." I've asked Myfxbook support about this, but they have no idea and told me it shouldn't have anything to do with the network.

Anyone have a solution for this, or some other way to share my results?

It seems that you're running publisher from the shared disk, maybe you'll need to install it in the primary partition. Some programs don't like to be run from the shares, unfortunately.

You could also try MT4i.

I have another issue with myfxbook where all four of them (check the link in my sig) mysteriously die after some days of running. They die at the same time. Happened twice so far. It's not a showstopper, of course, just somewhat annoying. Whatever I run on the Windows platform seems to die sooner or later.

Posted By: bfleming

Re: Z12 trade - 08/07/13 09:17

Figured it out, thanks. Problem was I was downloading the install file on my Mac. Downloading it via Parallels did the trick. You can see it here:

https://www.myfxbook.com/portfolio/z12/658133

Posted By: Sundance

Re: Z12 trade - 08/07/13 10:43

Right bfleming. The SL you see is a emergency SL. With the release of the next Zorro version you will additionally see the 'hidden' SL and TP Zorro has set. But i think the SL and TP move when you have an open trade. So you can always push a button to see the current values...

Posted By: bfleming

Re: Z12 trade - 08/07/13 11:46

Which button do you press to see the current values?

Posted By: Anonymous

Re: Z12 trade - 08/07/13 11:51

Which button do you press to see the current values?

'Result'

This is my Z12, snaphost from the last evening:

[NAS100:HU:L2707] 3062-3125-2968 +137.51$

[EUR/USD:HU:S2234] 1.3267-1.3309-1.3583 -39.40$

[GER30:VO:L2684] 8379-8277-8172 -104.00$

[USOil:HP:S2685] 107.01-105.48-107.30 +1.11$

[USD/CHF:HP:S1582] 0.9372-0.9260-0.9379 +133.79$

[XAG/USD:CT:S5611] 19.996-19.565-21.03 +29.08$

[XAG/USD:HP:S0473] 19.758-19.565-21.54 +16.79$

[GBP/USD:CY:S2073] 1.5349-1.5350-1.5743 -1.80$

Barely fits Zorro's window.

Still don't know what each number stands for, need to consult documentation...

Posted By: Sundance

Re: Z12 trade - 08/07/13 12:05

Oh acid. I don't know if bfleming has the beta version. On 1.12 you won't see any values.

Posted By: Anonymous

Re: Z12 trade - 08/07/13 12:06

Oh acid. I don't know if bfleming has the beta version. On 1.12 you won't see any values.

Oops... But then again, he will be able to see it soon.

Posted By: Sundance

Re: Z12 trade - 08/07/13 12:07

Yepp. Think so. At the moment 1.14 seems to be stable.

Posted By: bfleming

Re: Z12 trade - 08/07/13 15:35

hmm, when I clicked "Result" I got a chart and performance report for the selected currency. I didn't get anything like what you're showing...

Posted By: bfleming

Re: Z12 trade - 08/07/13 15:42

Ahhh... didn't see the comments above before I posted (was stuck on the previous page). So, that explains that

BTW, can someone explain to me how one would trade larger lots sizes if one had significantly more account balance than the required minimum? When I move the margin slider to 100 on, the minimum amount required is $11,032. But what if one had, say, $500,000?

Posted By: Sundance

Re: Z12 trade - 08/07/13 19:00

You ask this also on another thread and JCL hasn't answered till now. I haven't thought about it cause i'am far away from trading 10.000€ :-)

Posted By: WolfgangS

Re: Z12 trade - 08/07/13 22:49

I think, You will have to buy Zorro S and set MMax=10000 in Z.ini

Wolfgang

Posted By: bfleming

Re: Z12 trade - 08/08/13 06:04

Yeah, I searched the forum for an answer to this and asked it in another thread, but wasn't able to find/get an answer. I don't have $500K, I'm just curious is all

Posted By: Sundance

Re: Z12 trade - 08/08/13 06:24

Nice avatar Wolfgang. I think this is how the people in Bayern see the rest of the world. :-)

Posted By: WolfgangS

Re: Z12 trade - 08/08/13 09:30

Hi Sundance,

I picked this avatar, because the earth looks like the sky in Bavaria: White and Blue

Wolfgang

Posted By: Sundance

Re: Z12 trade - 08/08/13 09:36

Then it looks temporarily better then here in Bonn...

Posted By: Sundance

Re: Z12 trade - 09/27/13 06:31

Questions regarding Z12:

I read somewhere here at the forum that Z12 has some kind of intelligence. Meaning its learning from its former trades.

Q: Is this correct and what happens when I restart Z12 or update the Zorro version. Is Z12 than 'dumb' again?

At the moment Z12 has two shorts on USD/CHF. I can't see how they will be going into profit. The asset is already 'down' and when looking at a weekly timeframe I can't see how they will go down so that the stop loss will go break even.

Q: Will Z12 move the SL when the price isn't going nowhere for a given amount of time?

Q: I would like to see the next price level needed for a current trade so that SL is moving BE or at least going closer to the current price.

When I would see that USD/CHF must go down further 150pips to go BE I really would consider closing those trades.

thanks in advance

Posted By: jcl

Re: Z12 trade - 09/27/13 07:25

- Yes, it learns when you activate phantom trades in the .ini file. And yes, any restart makes Z12 dumb again. It's planned to change that in a future Z12 version.

- Depends on the algo. Some algos move the SL even when the price does not move.

- There is not really a price level. SL movement follows a rather complex algorithm.

Posted By: Sundance

Re: Z12 trade - 09/27/13 08:10

Thanks for the info jcl.

Posted By: Sundance

Re: Z12 trade - 09/27/13 09:09

I did two tests with Z12s. Same slider settings. One with and one without phantom trades:

Margin: 47

Risk: 10

without phantom trades: Annual +326% +62221p Capital: 4494$ Profit: 37981$

with phantom trades : Annual +250% +32506p Capital: 3404$ Profit: 22029$

So I set the margin slider to a value where the Capital is nearly the same as without Phantom trades.

Margin: 72

with phantom trades : Annual +293% +49055p Capital: 4560$ Profit: 32786$

It seems that Z12 has such a good performance that using phantom trades has any positive impact. So the phantom algo says: "Ups the equity curve doesn't look good any more lets suspend real trading and wait till the next profitable phantom trades arise". I think that just at this moment the next profitable real trade is around the corner and waits to be executed (which won't be)!? Conclusion: For Z12 phantom algo eats more profitable trades then it prevents bad trades from being executed?

jcl,

I always subscribed to the view that entries are a small part of trading and that the real money is made in good trade management, i.e knowing when to exit.

Can you share any of the complex stop management with us? Even point us in the right direction, for example:

1) I assume all z1 & z2 algos are symmetrical and all exit on an opposite signal if not stopped out.

2) Are any profit targets used on z2 algos? Again assuming no targets on z1 as they are trend following.

3) Does each algo have a tailored stop & exit tmf or is there sharing of tmfs in the broad trend & counter trend categories?

Posted By: jcl

Re: Z12 trade - 09/27/13 10:46

Yes, all algos are symmetrical. Profit targets are not used. Each algo has an individual exit algorithm.

Posted By: Sundance

Re: Z12 trade - 09/27/13 10:54

Hi jcl can you answer my suggestion above also? It's just for my understanding...

Posted By: Sundance

Re: Z12 trade - 09/27/13 11:34

WOW. I just rad the manual and found an information a knew already but forgot about:

By the way, the '$' sign in Zorro's messages does not necessarily mean US-Dollar, it stands for the account currency.

So it is a fault on my side to calculate a needed capital of 4000$ into € cause those 4000$ stand for 4000€?

My FXCM account is in €...

I just jumped into my VPS and lowered the margin slider !! *puuuh*

PS: The mistake is on my side but i really must say that using a currency symbol as a placeholder for the current currency is not optimal! Would be better to use any non currency symbol.

Posted By: royal

Re: Z12 trade - 09/28/13 09:32

When I would see that USD/CHF must go down further 150pips to go BE I really would consider closing those trades.

Why don't you just hedge them a bit? Then Zorro can go it's way and you can minimize your risk.

Posted By: Sundance

Re: Z12 trade - 09/28/13 19:24

I don't wan't to interference with the strategy in that way. Now it's already to late to handle price wen't up.

Posted By: Sundance

Re: Z12 trade - 10/21/13 19:51

Just a short post. Z12 won't do much trading since a few weeks.

07.10 GER30

07.10 USDCHF

02.10 USDCHF

17.09 USDCAD

So only 4 trades in a month. I have 3600€ at this account and it is the required capital. I think it is the market which only steps sideways!?

Posted By: Sundance

Re: Z12 trade - 10/22/13 11:43

I did a train on Z12 on 7.10.13.

The same day Z12 made its last trade.

@JCL: Can you see from the FAC/PAR file if there is something wrong??

FAC file:

EUR/USD:HU .000 0.00 0/4 3.5

EUR/USD:HU:L .000 ---- 0/0 -0.0

EUR/USD:HU:S .000 0.00 0/4 3.5

GBP/USD:EA .000 0.00 0/6 38.1

GBP/USD:EA:L .000 ---- 0/0 -0.0

GBP/USD:EA:S .000 0.00 0/6 38.1

GBP/USD:VO .000 0.22 1/7 12.2

GBP/USD:VO:L .000 ---- 0/0 -0.0

GBP/USD:VO:S .000 0.22 1/7 12.2

NAS100:CY .000 0.00 0/4 29.1

NAS100:CY:L .000 0.00 0/4 29.1

NAS100:CY:S .000 ---- 0/0 -0.0

NAS100:HU .000 0.00 0/4 29.1

NAS100:HU:L .000 0.00 0/4 29.1

NAS100:HU:S .000 ---- 0/0 -0.0

SPX500:EA .000 0.00 0/1 18.2

SPX500:EA:L .000 0.00 0/1 18.2

SPX500:EA:S .000 ---- 0/0 -0.0

SPX500:HU .000 0.00 0/5 91.0

SPX500:HU:L .000 0.00 0/5 91.0

SPX500:HU:S .000 ---- 0/0 -0.0

US30:CY .000 0.00 0/6 92.5

US30:CY:L .000 0.00 0/6 92.5

US30:CY:S .000 ---- 0/0 -0.0

USD/CAD:EA .000 0.00 0/6 4.5

USD/CAD:EA:L .000 ---- 0/0 -0.0

USD/CAD:EA:S .000 0.00 0/6 4.5

USD/CAD:ES .000 0.00 0/6 4.5

USD/CAD:ES:L .000 ---- 0/0 -0.0

USD/CAD:ES:S .000 0.00 0/6 4.5

USD/CHF:CT .000 0.00 0/4 3.7

USD/CHF:CT:L .000 ---- 0/0 -0.0

USD/CHF:CT:S .000 0.00 0/4 3.7

USD/CHF:HU .999 6.78 2/4 -21.5

USD/CHF:HU:L .999 6.78 2/4 -21.5

USD/CHF:HU:S .000 ---- 0/0 -0.0

USD/CHF:LP .000 0.00 0/2 1.9

USD/CHF:LP:L .000 0.00 0/2 1.9

USD/CHF:LP:S .000 ---- 0/0 -0.0

USD/CHF:LS .000 0.00 0/2 1.9

USD/CHF:LS:L .000 0.00 0/2 1.9

USD/CHF:LS:S .000 ---- 0/0 -0.0

USOil:BB .000 0.00 0/2 36.4

USOil:BB:L .000 ---- 0/0 -0.0

USOil:BB:S .000 0.00 0/2 36.4

USOil:EA .000 0.00 0/5 91.0

USOil:EA:L .000 0.00 0/5 91.0

USOil:EA:S .000 ---- 0/0 -0.0

USOil:ES .000 0.00 0/9 163.8

USOil:ES:L .000 0.00 0/6 109.2

USOil:ES:S .000 0.00 0/3 54.6

PAR file:

EUR/USD:BB 112 0.785 3.08 8.42 8.91 0.730=> 0.831

EUR/USD:CT 0.887 +0.552 1.30 2.43 8.92 0.730=> 1.059

EUR/USD:CY 0.403 0.298 0.607 8.40 8.91 0.796=> 1.211

EUR/USD:HP 1.24 0.450 1.74 8.40 8.92 0.796=> 1.205

EUR/USD:VO 2.91 44.1 2.01 43.9 0.249 0.609=> 1.108

EUR/USD:LP 1.21 4.46 8.78=> 1.053

EUR/USD:HU 17.2 8.93 4.95=> 1.634

EUR/USD:ES 2.37 4.46 0.287 0.509 0.608=> 1.180

EUR/USD:EA 2.16 1.44 3.72=> 0.935

EUR/USD:LS 1.21 4.46 0.122 0.122 0.804=> 0.973

USD/CHF:BB 513 1.69 0.670 8.47 8.89 0.796=> 0.931

USD/CHF:CT 0.605 0.692 0.892 8.44 8.91 0.730=> 0.930

USD/CHF:CY 0.654 0.294 0.670 5.22 8.91 0.730=> 1.037

USD/CHF:HP 0.223 0.401 0.608 8.45 8.91 0.730=> 1.325

USD/CHF:VO 3.13 36.9 2.00 226 0.200 15.6=> 1.556

USD/CHF:LP 1.34 1.74 7.26=> 1.510

USD/CHF:HU 7.29 1.22 1.74=> 1.489

USD/CHF:ES 1.21 4.46 0.162 0.509 0.737=> 1.218

USD/CHF:EA 1.21 2.10 2.54=> 1.392

USD/CHF:LS 1.34 4.46 0.134 0.347 0.802=> 1.413

GBP/USD:BB 423 2.02 0.607 8.48 8.90 0.730=> 0.742

GBP/USD:CT 1.74 0.691 1.91 2.68 8.92 0.796=> 1.023

GBP/USD:CY 0.334 0.806 3.38 8.47 8.92 0.730=> 0.841

GBP/USD:HP 1.35 0.299 4.09 2.94 8.92 0.730=> 1.002

GBP/USD:VO 2.18 110 1.82 44.0 0.300 17.0=> 0.884

GBP/USD:LP 1.22 1.91 3.72=> 1.176

GBP/USD:HU 11.8 8.18 12.9=> 1.357

GBP/USD:ES 2.15 3.72 0.745 0.508 0.609=> 1.182

GBP/USD:EA 1.47 0.608 12.8=> 0.963

GBP/USD:LS 1.22 4.46 0.134 0.287 0.608=> 1.094

USD/CAD:BB 102 2.03 0.891 8.45 8.90 0.730=> 1.698

USD/CAD:CT 1.57 0.905 1.08 2.94 8.92 0.796=> 1.225

USD/CAD:CY 0.871 1.10 2.80 2.43 8.92 0.730=> 0.725

USD/CAD:HP 1.48 0.500 0.608 3.56 8.91 0.730=> 1.065

USD/CAD:VO 2.13 36.6 1.82 53.0 0.300 17.0=> 0.849

USD/CAD:LP 1.47 1.31 8.77=> 1.076

USD/CAD:HU 17.4 8.97 17.0=> 1.572

USD/CAD:ES 1.34 1.44 0.508 0.122 0.609=> 1.013

USD/CAD:EA 1.22 1.30 17.1=> 0.944

USD/CAD:LS 1.47 1.43 0.892 0.147 0.609=> 1.070

USD/JPY:BB 216 3.95 +0.525 6.95 1.47 0.730=> 31.858

USD/JPY:CT 0.737 1.00 0.810 6.95 3.80 0.797=> 1.360

USD/JPY:CY 2.24 1.20 4.09 8.43 8.92 0.730=> 2.145

USD/JPY:HP 0.764 0.500 4.09 2.95 8.92 0.796=> 1.071

USD/JPY:VO 2.96 36.6 1.82 76.2 0.403 0.609=> 0.999

USD/JPY:LP 1.21 0.737 3.38=> 1.164

USD/JPY:HU 7.23 4.62 17.1=> 1.297

USD/JPY:ES 1.21 2.79 0.147 0.420 0.736=> 1.005

USD/JPY:EA 9.54 0.977 1.31=> 1.763

USD/JPY:LS 1.21 4.10 0.237 0.122 0.736=> 1.078

AUD/USD:BB 57.3 2.23 0.608 8.38 8.89 0.730=> 1.308

AUD/USD:CT 1.43 1.01 0.608 3.24 8.89 0.796=> 0.880

AUD/USD:CY 2.25 0.298 4.09 2.43 8.92 0.796=> 1.229

AUD/USD:HP 1.35 0.550 1.30 8.36 8.90 0.730=> 0.996

AUD/USD:VO 2.04 109 1.82 43.9 0.249 15.6=> 1.017

AUD/USD:LP 1.47 1.91 0.810=> 1.375

AUD/USD:HU 7.24 8.94 10.6=> 0.977

AUD/USD:ES 1.22 4.46 0.162 0.316 0.803=> 1.074

AUD/USD:EA 1.22 1.58 0.980=> 1.103

AUD/USD:LS 1.47 4.47 0.559 0.261 0.802=> 1.264

NAS100:BB 266 3.50 1.08 2.43 8.92 0.730=> 16.523

NAS100:CT 1.44 0.698 0.606 8.41 8.90 0.730=> 1.132

NAS100:CY 0.300 0.297 0.609 8.40 8.91 0.796=> 0.960

NAS100:HP 0.691 0.293 0.607 8.42 8.91 0.796=> 1.075

NAS100:VO 2.84 109 1.81 225 0.400 11.7=> 0.915

NAS100:LP 1.21 4.46 17.0=> 0.751

NAS100:HU 8.87 8.96 7.25=> 1.007

NAS100:ES 2.87 1.58 0.420 0.287 0.609=> 1.248

NAS100:EA 2.88 0.736 17.0=> 1.134

NAS100:LS 1.21 1.91 0.819 1.74 0.737=> 0.893

SPX500:BB 52.0 2.46 0.607 8.38 8.94 0.730=> 2.556

SPX500:CT 0.604 0.800 4.09 8.43 8.91 0.730=> 1.322

SPX500:CY 0.303 0.798 0.608 8.43 8.92 0.730=> 1.466

SPX500:HP 0.523 0.947 0.670 +9.58 +1.05 0.801=> 1.254

SPX500:VO 2.91 36.8 2.22 43.9 0.350 14.1=> 0.964

SPX500:LP 1.47 0.607 1.43=> 1.557

SPX500:HU 8.83 2.60 12.8=> 1.358

SPX500:ES 4.61 1.74 0.122 0.991 0.802=> 1.128

SPX500:EA 1.22 0.608 17.1=> 0.972

SPX500:LS 1.47 1.74 0.894 1.74 0.802=> 1.288

US30:BB 47.5 3.50 0.609 6.95 8.92 0.730=> 115.141

US30:CT 0.807 0.701 3.72 8.44 8.92 0.796=> 1.302

US30:CY 0.303 0.288 1.91 8.39 8.92 0.796=> 1.169

US30:HP 0.323 0.399 1.19 8.41 8.91 0.796=> 1.401

US30:VO +1.53 109 1.82 226 0.401 17.0=> 0.967

US30:LP 1.22 0.892 3.38=> 1.058

US30:HU 11.7 8.94 11.7=> 1.087

US30:ES 5.08 1.31 0.178 1.20 0.803=> 1.435

US30:EA 5.07 0.892 0.607=> 1.860

US30:LS 1.22 2.10 0.237 0.196 0.804=> 0.920

GER30:BB 29.5 0.713 0.607 8.42 8.91 0.730=> 1.269

GER30:CT 0.884 1.69 4.09 3.92 8.92 0.796=> 1.575

GER30:CY 0.491 0.502 0.604 8.40 8.92 0.796=> 1.489

GER30:HP 1.01 0.948 1.30 +9.68 8.92 0.730=> 0.517

GER30:VO +1.52 36.6 1.82 63.5 0.400 0.609=> 1.087

GER30:LP 1.20 1.43 17.1=> 0.953

GER30:HU 11.8 7.44 17.1=> 1.600

GER30:ES 3.81 0.980 0.134 0.237 0.608=> 2.083

GER30:EA 3.83 0.604 4.95=> 2.508

GER30:LS 1.20 1.73 0.196 1.74 0.802=> 0.888

USOil:BB 35.4 1.26 1.19 8.42 8.91 0.730=> 1.041

USOil:CT 0.605 0.686 0.607 7.64 8.91 0.796=> 0.988

USOil:CY 0.403 0.401 0.609 8.40 8.91 0.730=> 1.338

USOil:HP 0.357 0.400 0.891 8.40 8.92 0.730=> 1.213

USOil:VO 3.14 36.5 2.67 76.1 0.349 0.609=> 2.141

USOil:LP 1.62 1.91 7.98=> 1.128

USOil:HU 7.26 8.92 17.0=> 1.224

USOil:ES 3.82 2.10 0.892 0.819 0.737=> 1.188

USOil:EA 4.20 2.54 2.31=> 1.419

USOil:LS 1.62 2.54 0.216 0.196 0.608=> 1.206

UK100:BB 26.6 2.63 3.72 8.55 8.92 0.730=> 1.034

UK100:CT 0.599 1.90 1.30 2.63 8.92 0.730=> 16.225

UK100:CY 1.15 0.291 4.09 3.56 8.92 0.730=> 1.310

UK100:HP +0.205 0.741 0.609 9.18 8.92 0.730=> 4.774

UK100:VO 2.83 91.5 1.82 226 0.300 0.609=> 0.948

UK100:LP 2.16 1.08 4.51=> 1.098

UK100:HU 15.7 8.93 0.609=> 1.476

UK100:ES 5.04 4.47 0.615 0.216 0.609=> 1.391

UK100:EA 1.21 0.810 17.1=> 0.927

UK100:LS 2.16 1.30 0.677 0.382 0.669=> 0.912

XAU/USD:BB 112 1.69 2.80 2.95 8.92 0.730=> 1.045

XAU/USD:CT 0.809 0.688 1.19 8.48 8.90 0.796=> 1.026

XAU/USD:CY 3.58 0.297 0.608 6.95 8.90 0.730=> 1.244

XAU/USD:HP 3.47 0.897 0.809 2.95 1.21 0.796=> 1.006

XAU/USD:VO 2.99 110 2.65 44.1 0.399 0.609=> 1.395

XAU/USD:LP 1.78 2.80 0.609=> 1.660

XAU/USD:HU 17.2 2.37 1.30=> 1.469

XAU/USD:ES 7.44 4.48 0.895 0.677 0.802=> 1.209

XAU/USD:EA 1.79 2.55 9.64=> 1.248

XAU/USD:LS 1.78 3.08 0.178 0.420 0.736=> 1.399

XAG/USD:BB 24.3 0.647 0.607 4.31 8.90 0.730=> 1.019

XAG/USD:CT 0.605 0.699 0.608 7.64 8.91 0.796=> 1.071

XAG/USD:CY 0.368 0.805 1.08 8.49 8.91 0.796=> 2.418

XAG/USD:HP 0.324 0.451 0.981 8.50 2.60 0.730=> 1.400

XAG/USD:VO 2.87 110 1.82 43.8 0.201 0.609=> 1.225

XAG/USD:LP 3.82 4.09 2.54=> 2.076

XAG/USD:HU 8.05 4.63 11.7=> 1.503

XAG/USD:ES 1.78 4.46 0.122 0.677 0.609=> 1.351

XAG/USD:EA 1.78 2.54 3.38=> 1.546

XAG/USD:LS 3.82 4.45 0.122 0.382 0.803=> 1.759

would be a laugh if there is a problem...

Posted By: Sundance

Re: Z12 trade - 10/22/13 11:54

I just renamed the trained files and copied the original Z12.par and FAC file from 2.8.2013 into the data folder.

Now I'am on the safe side and will see if there will be trades within the next days...

Posted By: Chaosfreak

Re: Z12 trade - 10/22/13 11:55

Hi Sundance,

your FAC file is definitely wrong. All lines begin with .000, so Zorro doesn't make any trade. I would suggest you to retrain the strategy or use the original files.

Posted By: Sundance

Re: Z12 trade - 10/22/13 12:12

Thanks Chaos,

I haven't looked at the file structure. Many thanks for the info! It's really essential to read the whole manual every day.

then I wonder why the train made those .000 values...

LOL. 5 Minutes later Z12s did take two trades. OMG. Three weeks of waiting for the train which would never come :-|

Posted By: DMB

Re: Z12 trade - 10/22/13 12:45

I sometimes think that my Z12 is making far too few trades as well. Can you do me a favour and post the correct pac file contents like you did for you faulty one above. I want to see if my VPS Zorro is running with the correct input data.

Thanks in advance.

EDIT: My Z12.fac has many many more rows than yours. Eg, EURUSD has about 30 rows, one for each algo and trade direction. About half are 0.00, but there are plenty that are not. Interesting learn about this side of things.

EDIT AGAIN: Don't worry about it. I am satisfied that my live zorro is using the correct fac.

Posted By: Sundance

Re: Z12 trade - 10/22/13 16:00

Hi DMB,

just came home from running. So you don't need the files anymore?

Posted By: Sundance

Re: Z12 trade - 10/22/13 16:26

So i trained Z12 again using the command line option

Zorro.exe -train Z12s

Here is the content of the Z12.fac file:

AUD/USD:CY .999 12.68 4/1 -83.6

AUD/USD:CY:L .000 ---- 0/0 -0.0

AUD/USD:CY:S .999 12.68 4/1 -83.6

EUR/USD:CT .000 0.00 0/6 97.1

EUR/USD:CT:L .000 0.00 0/6 97.1

EUR/USD:CT:S .000 ---- 0/0 -0.0

USD/CHF:CT .000 0.00 0/6 119.8

USD/CHF:CT:L .000 ---- 0/0 -0.0

USD/CHF:CT:S .000 0.00 0/6 119.8

USD/CHF:HP .000 0.00 0/6 142.5

USD/CHF:HP:L .000 ---- 0/0 -0.0

USD/CHF:HP:S .000 0.00 0/6 142.5

USD/JPY:EA .000 0.01 1/11 113.8

USD/JPY:EA:L .000 0.00 0/6 19.1

USD/JPY:EA:S .000 0.01 1/5 94.7

USD/JPY:ES .000 0.00 0/6 19.1

USD/JPY:ES:L .000 0.00 0/6 19.1

USD/JPY:ES:S .000 ---- 0/0 -0.0

USD/JPY:LP .999 ++++ 6/0 -101.5

USD/JPY:LP:L .999 ++++ 6/0 -101.5

USD/JPY:LP:S .000 ---- 0/0 -0.0

USD/JPY:LS .513 ++++ 6/0 -101.5

USD/JPY:LS:L .513 ++++ 6/0 -101.5

USD/JPY:LS:S .000 ---- 0/0 -0.0

USOil:CT .000 0.00 0/3 204.4

USOil:CT:L .000 0.00 0/3 204.4

USOil:CT:S .000 ---- 0/0 -0.0

USOil:CY .000 0.00 0/6 408.8

USOil:CY:L .000 0.00 0/6 408.8

USOil:CY:S .000 ---- 0/0 -0.0

XAU/USD:CY .999 35.16 5/1 -219.0

XAU/USD:CY:L .000 ---- 0/0 -0.0

XAU/USD:CY:S .999 35.16 5/1 -219.0

For me it looks not really okay. UsOil has only .000 values !

Some hint for me (JCL) ?

Posted By: Sundance

Re: Z12 trade - 10/22/13 16:33

When training i saw the following line a few times:

(XAG/USD:VO:L)Error010:Pricexx.xx ....

Posted By: jcl

Re: Z12 trade - 10/22/13 16:39

The factors are not ok, and the reason is apparently not enough trades in the training period. We'll check the reason of this. Inbetween please continue with the original .fac and .par files - retraining them is not yet necessary. There will be also a new update in the next time with a new parameter set.

Have you downloaded new prices before training?

Posted By: Sundance

Re: Z12 trade - 10/22/13 17:13

I can't remember to 100% so i will run the download script and again will do a train.

Posted By: TMM

Re: Z12 trade - 11/08/13 10:31

I have just started testing Z12 i have 2 trades on AUD/USD where the stop is more that 4000pips from the entry price.ie but .95xx stop .53xx The trades have been open for at least a day with no update on the stop.

Does this look ok?

i saw somewhere a comment on the forum that it did not look coorect.

Posted By: Sundance

Re: Z12 trade - 11/08/13 11:58

I also have two AUDUSD trades open:

SLs are 0.95689 and 0.96930. Those are emergency SLs. You can see the real SLs when you hit the 'Result' button at the Zorro GUI. From what i see the emergency SLs are okay. The real SLs used by Zorro are much tighter.

Posted By: TMM

Re: Z12 trade - 11/08/13 12:21

ok thanks I see it

Posted By: Sundance

Re: Z12 trade - 11/11/13 09:57

I have a question:

One of the trades Z12s took surprises me:

11.09.2013 16:20 USDCAD Sell 0.11 1.04181

I can't see how the open price was ever reached at the 09/08.11.2013.

The lowest price between 07.11 and 11.11 was ~1.044 .

@jcl: Can you confirm that this is not an error. If this trade was taken with a 'huge' spread then I would like to set a threshold for a maximum spread.

Posted By: jcl

Re: Z12 trade - 11/11/13 10:05

I cannot answer why you got that price - you must ask your broker about that. Check that trade in the trading station or in MT4. If you want to complain about a certain trade, contact the broker support and give them the trade ticket number - they'll look into it.

Posted By: Sundance

Re: Z12 trade - 11/11/13 11:09

So there is no way to prevent such a trade. Okay. Zorro knows the actual values of current price and spread and sends the order to the broker. What the broker then gives Zorro back can be something completely different.

Thats life.

I think it is a good idea to ask FXCM how such a price could be possible.

Thank you...

Posted By: jcl

Re: Z12 trade - 11/11/13 14:23

It is theoretically possible to prevent a trade at a bad price, using a pending trade with an entry limit. But the current Z systems don't do that but just enter at market.

jcl,

can zorro not set a max slippage when sending an order in real trading?

Metatrader can do this I think, so it should be relatively easy to code it in the metatrader bridge.

I understand that for the z-strategies on 1 - 4 hr timeframes it is a minor issue, but for those trading lower time frames, it may be useful. I know some traders who implement a max slippage and a max spread filter before taking any trade.

Posted By: jcl

Re: Z12 trade - 11/12/13 07:09

Yes, this can certainly be implemented with any broker API, using an entry limit. It requres a new plugin function. I'll put that on my list.

Posted By: Sundance

Re: Z12 trade - 12/06/13 21:01

Hi JCL.

Zorro 1.20 is out. Can you tell me when the s versions of the stratgys will be available?

Thanks in advance

Sundance

Posted By: jcl

Re: Z12 trade - 12/07/13 14:13

Subscribed updates are normally sent out within one day.

If there's a problem with your subscription, please contact Support - check also if your email address is still up to date and not blocked by a spam blocker etc.

Posted By: Sundance

Re: Z12 trade - 12/07/13 16:44

Sorry. Ithink the problem is on my site. I bougth the Zorro S version. Then I can use the Z strategies that are coming with the Zorro download!?

I thougth that I would need also the s versions of the Z strategies but this is wrong. But that was only true at the time I had only bougth the S strategies and not the Zorro s version.

So I will run the Z12 and the new / modified Z5 version which comes with the standard download!!

Can you confirm jcl??

thanks

Sundance

Posted By: jcl

Re: Z12 trade - 12/07/13 16:58

Yes, with Zorro S you won't need subscriptions anymore and can use the normal strategies. Still, as long as you haven't terminated the subscriptions you should have received them also.

Posted By: Sundance

Re: Z12 trade - 01/02/14 20:29

Sometimes i really wonder where Z12 is setting its SL.

On 24th December it opened GPBUSD. Price: 1.63723

Today it went up to +230pips to 1.66 which was a profit of ~800€s.

Then some hours later price went down to 1.63723 and the trade was closed with a profit of 56,3 pips (~250€s). What a huge SL that was. Has someone also had this trade and can confirm the SL setting?

Posted By: DMB

Re: Z12 trade - 01/02/14 21:49

I did something naughty. I exited that GPBUSD trade somewhere high on that price spike. I think I got around 160 pips. Later, however, Z3 took a USDCHF trade that was way too large compared to the other usual positions and I got slammed. Overall, I am nearly back to my starting balance after being up about 40% with the three Zs and after lowering my margin settings to a third of the original setting so that I could get used to the swings. This draw down all occurred this week. Was this holiday trading irregularity???

Just venting my frustration....I'll get over it. I'll set my margins even lower and try to rebuild.

Posted By: Sundance

Re: Z12 trade - 01/02/14 22:02

I feel with you DMB! I know what you mean. I'am down ~10% with my Z12 and its not really taking many trades. I'am surely a little bit surprised but stay away to intervene Z12. We both will see in some month if we are nearly there where the backtest should lead us to....

Posted By: DdlV

Re: Z12 trade - 01/03/14 02:36

Hi Sundance. Yes, I also have that Z12 trade - entered at 1.6370, run up, back down, exited today at 1.6430. The stop listed in the daily messages is 1.6215. Clearly that wasn't hit and is a failsafe, with the trade actually handled by a TMF which stopped it.

I also have a prior GBP/USD opened that same day & closed at the next bar for a small loss.

acidburn's Demo has neither trade.

I'm sure the explanation (which I'd agree with) is that you can't look at just one trade - the strategy is set for overall return and can't be set for individual trade return via 20/20 hindsight

. Unfortunately, Z12 isn't doing so well...

It's the worst performer by far on acidburn's Demo, which is hard to understand as it's supposed to be the combination of Z1 and Z2 - the big winner - which itself isn't even at breakeven...

Posted By: DMB

Re: Z12 trade - 01/03/14 02:53

@Sundance - Well, since the Z12 backtest is based on new optimisation periods each time, there is no way to see if the real trading resembled the simulated trading for the same period. When a new Zorro is released that has been re-optimised, the entire backtest history is re-optimised. I found this odd, given that there is mention in the tutorial of 'Retrain' and 'SelectWFO = -1;' So it is impossible to see if the sideways / drawdown is a true result or if the optimisation fails each time. That's black box trading for you!

Secondly, Acidburn's demo has been running for six months now. It is still in drawdown. I am pretty sure there is no six month period in the back test with a drawdown. The Zorro people tell me that it is probably because the demo is started and stopped so much and there is some learning that is lost. This indicates to me that it is too sensitive to this 'learning' and that makes me nervous.

I know I am not trading the Zs as a totally non-intervention robot, but you are and and the demo is. Yet we are all showing nothing impressive. And unfortunately I totally suck at creating my own stuff.

I was up $1,400 last week. Now I am up $18. I know it has ups and downs, but my margin settings are at 20 to try to reduce these wild swings (at one stage with default settings I was up $2,400 before losing $1,500 in a few days.)

Posted By: Anonymous

Re: Z12 trade - 01/03/14 08:47

I am guessing the good guys behind the zorro project must have some accounts set up to track the progress of the Z strategies from the first installment of zorro. It wont be a bad idea for them to link it to myfxbook and have a thread dedicated to observing this progress. Seeing as we cant just run a "test" on the Z strategies and see how they would have performed giving the period they have been live. Just a suggestion. Live profitable systems are always an encouragement to the community.

Posted By: Sundance

Re: Z12 trade - 01/03/14 08:59

Thanks for your posts guys. When I look at the equity chart of Z12 there you can see a flat area from ~October to January/February in 2011 and 2012. So I still have hope that this is the third time we see such a behavior. My plan is to let Z12 run till End of this year without intervention. I that time I will change to newer versions of Zorro. Even when there is a drawdown it surely should must made some profit in 12 month. Changing versions won't kill a ~300% profit to 0%.

Time will tell.

The Z5 strategy performed as it should. Even when I don't like this grid trading...

Posted By: Anonymous

Re: Z12 trade - 01/03/14 09:49

It's the worst performer by far on acidburn's Demo, which is hard to understand as it's supposed to be the combination of Z1 and Z2 - the big winner - which itself isn't even at breakeven...

Definitely Z12 is not performing well. But, if we normalize by the required capital as reported by the backtest, even that is an understatement. With current 100/20 margin/risk setting, the backtest reports 7921 as required. And Z12 is currently (50000-46427) = 3573 underwater. That translates to a 45% drawdown which is totally not acceptable in my book.

I'm close to rule some or all of the Z's unprofitable and terminate the demo. If I decide to be selective, Z12 will obviously be the first one to go.

Secondly, Acidburn's demo has been running for six months now. It is still in drawdown. I am pretty sure there is no six month period in the back test with a drawdown. The Zorro people tell me that it is probably because the demo is started and stopped so much and there is some learning that is lost. This indicates to me that it is too sensitive to this 'learning' and that makes me nervous.

The truth is that recently strategies in the demo have had long (read: multi-week) periods of uninterrupted running. Even when they were restarted in most cases the restarts took place on weekend, i.e. when the market is closed. As the phantom trading has been turned off since the beginning (and only that component should be somewhat sensitive to restarts) I'm just not buying the explanation that restarts could have been the reason for the bad performance. And I knew that restarts would come into spotlight sooner or later, but I really don't believe one bit that running uninterrupted for months would have changed anything. Not to mention that with such approach I would probably still be running 1.14 or so...

Posted By: Anonymous

Re: Z12 trade - 01/03/14 09:55

Just took a look at your demos. I have to say something does not add up. The disparity between Z1, Z2 and Z12 is too great. But then again we need atleast a year of forward tests to make decisions. So lets wait it out a bit.

Posted By: Anonymous

Re: Z12 trade - 01/03/14 10:33

Just took a look at your demos. I have to say something does not add up. The disparity between Z1, Z2 and Z12 is too great.

You're right. In the beginning I could add up the perfomance of Z1 & Z2 and come close to Z12 numbers. Not anymore. I don't know why.

But then again we need atleast a year of forward tests to make decisions. So lets wait it out a bit.

That's what I thought. But, with 45% drawdown after 6 months, I don't anymore. If it was real money I would already stopped trading at about 20% drawdown and declared the strategy unprofitable and dangerous. Of course, we all have different risk appetites, but 45% drawdown is just not acceptable under no circumstances. It becomes clearer when you understand that in the next 6 months we'd need Z12 to have 80% profit just to break even (get back to the starting capital). I'm afraid Z12 is now beyond the point of no return.

Posted By: DMB

Re: Z12 trade - 01/03/14 10:46

Not withstanding anything that has been said, the Capital Required is a drawdown that should be expected at some point, statistically speaking. So if you only want to risk a 20% drawdown, then the Capital Required should be 20% of your account.

But I tend to agree that Z12 is not looking good.

Posted By: Sundance

Re: Z12 trade - 01/03/14 11:12

I really won't believe that the strategies are loosers. If I won't see a profit within the next 3/4 month then there must be something wrong. This would mean I have a new flat area of half a year which I can't see in the backtest of Z12 anywhere...

Posted By: DMB

Re: Z12 trade - 01/03/14 11:25

Those flat periods you mentioned where not there on the version 1.16 Z12. There were flat periods but at other times. It happens, but this one is long.

I am relieved that I am not the only one seeing all this (misery likes company

) But I don't think I can turn on my live real money Z12 (or Z3) until something positive is demonstrated. That'll take many months from this point. Long live Z5.

Posted By: Anonymous

Re: Z12 trade - 01/03/14 12:12

Not withstanding anything that has been said, the Capital Required is a drawdown that should be expected at some point, statistically speaking. So if you only want to risk a 20% drawdown, then the Capital Required should be 20% of your account.

Hm, you're right. I had totally wrong perception of that value this whole time. But if 'Capital' is not what I thought it was, then of course my whole calculation makes no sense.

I'm afraid I get bitten way too often with terminology and concepts behind Z strategies money management. Partly because I'm afraid of it, partly because it *is* complex stuff. And mostly because I still haven't done my homework.

Let me try again then. With 100/20 settings, if the capital, actually, the expected max drawdown is around $8000, and if I tend not to tolerate drawdown bigger than 20%, that would mean I need to start with $8000 * (100% / 20%) = $40000. Am I right so far? That's not far from starting 50000, then.

So I could actually modify it a little bit and say that I started with $50000 not because FXCM didn't give me another option, but because I decided I would not like more than 15.8% drawdown.

If we agree with the above, Z12 is only 7.5% in drawdown, just as myfxbook reports. That's not bad. Now I only have trouble calculating what was my target profit? Is it 324% annualy as backtest reports? I doubt it. Or is it now 324 * (50000/7921) = 51%? I must ask because I need to compare the current drawdown with expected return to get to any meaningful conclusion about the strategy performance.

Posted By: jcl

Re: Z12 trade - 01/03/14 12:35

All Z strategies are permanently live traded by us for comparing them with their theoretical performance. They are all still perfectly within their statistical boundaries. No real drawdown so far was even close to the theoretical maximum drawdown.

If this ever happened, it would indicate that this strategy is expired. It will then be removed or replaced.

Posted By: DMB

Re: Z12 trade - 01/03/14 12:49

Your calculations look good to me, well at least the 7.5% and 51% are good based on you $50k account. To actually put it into a calculator, type 3.24 x 7921 / 50000. But I know you know what you mean.

It puts a different perspective on it. When I turned down my margins I did it such that the total capital required for Z3, Z5 and Z12 would be about 80% of my account. If they all went bad at the same time to the greatest historical extent ( and I didn't stop it on the way) I would lose 80% of my account. At these margin settings, each system made about 200% to 250%. So with some blurring of my eyes I figured I could expect overall 200% return on my account balance. That was my thinking about a month ago.

Posted By: Anonymous

Re: Z12 trade - 01/03/14 12:50

@jcl. It will be nice for the community to have a look at this progress. Seeing as we are all in this together? I believe it will instill some motivation in us to continue reading and trying to come up with strategies.

@acidburn: I think you are on the right path. Your computation of returns should take into account the account balance you need to fit your risk appetite(drawdown).

Posted By: Anonymous

Re: Z12 trade - 01/03/14 14:44

I'd like to thank you both DMB and liftoff for confirming my calculations. It's very important that we have a same view, at least on this basic stuff. Obviously I was wrong for a long time. I even remember saying that Zorro can't be adapted to the standard FXCM demo account, and now suddenly the world is not flat and $50000 matches 100/20 setting pretty nicely. Though I also remember having opened questions at that time that never got answered, no wonder I was lost in the dark for such a long time.

Realization that 'Capital' is actually an estimation of the biggest expected drawdown as per the backtest now opens a whole lot of additional questions. DMB, your calculation with 80% looks mathematicaly OK. But, I wonder can we expect that backtest results will be matched in real trading. Have you ever heard that somebody designed, backtested and then run the system only to find that the results in the live trading were even better? Never happened.

What I want to say, and based on my numbers before. M/R 100/20, $50000 starting capital, we backtested and expect 51% annual profit and not more than about 16% drawdown. In reality (read: live trading) we should probably be very happy with 25% after 12 months of trading and if drawdown is not more than say 30%. Does that look reasonable? Reminding once again, with Margin 100 and $50000 of starting capital.

Translating to a more realistic situating but with real money and say $2000 account, to keep the numbers above and if the required capital scales about linearly with the Margin slider, it would mean setting Margin slider at about 4 (=100*2k/50k). Moving it already to just 5 would mean both increased expected profit but also risk of ruin. Am I wrong with any of this?

Finally, we concluded my Z12 demo has aspirations of earning about 50% in a year. As we're about half year through, that translates to about 22% expected in half a year. Versus -7.5% realized. What can we now conclude, is it bad, good, or just ugly (and we have to wait a lot longer to let it reveal it's potential)? After todays conversation, I'm inclined to once again believe that not enough time has passed (yesterday I believed that Z12 plain sucks).

How about another 6 months of Z12 demo, with the current parameters, and than deciding based on the following criteria:

Z12 ends with -> verdict

------------------------

-15% -> plain sucks

-7.5% -> not profitable anymore

~ 0% -> has potential, but not worth it really

+15% -> profitable strategy

+30% -> excellent strategy

Who agrees?

Posted By: Sundance

Re: Z12 trade - 01/03/14 15:45

Don't know if i should agree. I'am taking the short track. Just watching my real account and thats it. I agree with JCL that at the moment everything is within the given parameters.

But you are right. In 6 month there must be a minimum plus...

Posted By: Anonymous

Re: Z12 trade - 01/03/14 15:49

Don't know if i should agree. I'am taking the short track. Just watching my real account and thats it. I agree with JCL that at the moment everything is within the given parameters.

But, you sure have your personal expectations both about your expected profit and drawdown. Would you care to share your numbers/settings? What performance would make you happy, and at what drawdown you would call it a day and cut the loss?

Posted By: Sundance

Re: Z12 trade - 01/03/14 15:52

:-)

My personal expectation is 100% gain in 12 month.

I would run it till it has eaten my 5000€ I guess. But I must confess that I had a bad attitude as I got a 1000€ loss. :-)

Period: 240

Margin: 65

Risk: 10

Panic: 0

Posted By: Sundance

Re: Z12 trade - 01/03/14 16:28

I have less trades then you have with your 50000€ demo but I can't set the margin slider any higher or the risk is to high. The manual stated that I need 5000€ for trading Z12 with 'full throttle' ...

Posted By: Anonymous

Re: Z12 trade - 01/03/14 16:31

OK, I have to admit you have an appetite for risk. You... adventurous soul!

It's also good that you trade only the money that you can afford to lose, because by my rough calculations above, the ruin is a quite probable event.

Although, now that the backtest with your input settings has finished, beside $4645 of required capital, I also see DD of $2868. As I can't readily distinguish between the two values without first digging in the manual, I think I might be once again missing something important.

Posted By: Sundance

Re: Z12 trade - 01/03/14 16:41

I changed the Z12 settings now to:

Margin: 60

Risk: 20

Posted By: Anonymous

Re: Z12 trade - 01/03/14 16:43

Well in the game of trading, the market usually rewards you for the risk you are willing to take, as long as you are not exploiting an arbitrage position. I am ready to sit on a 60 to 80% drawdown it must come to it as long as the trades in the live session fall within statistical expectation. I believe the capital required is calculated as the maximum drawdown plus the maximum margin required in the test period.

Makes perfect sense to me to be honest. Its how much capital you will need to to hopefully weather the storm, but if its a hurricane then you can possible lose everything. That is why its usually a good idea to go in with atleast 1.5 times the capital required for a risk loving person like myself and maybe a 5 times capital required for a risk averse person like yourself.

But remember your returns are based on the risk you are willing to take.

Posted By: Anonymous

Re: Z12 trade - 01/03/14 16:47

I changed the Z12 settings now to:

Margin: 60

Risk: 20

That should fix it.

Posted By: Sundance

Re: Z12 trade - 01/03/14 16:52

:-). I did a retest and the needed capital is okay. :-)

Posted By: Anonymous

Re: Z12 trade - 01/03/14 18:50

Well in the game of trading, the market usually rewards you for the risk you are willing to take, as long as you are not exploiting an arbitrage position. I am ready to sit on a 60 to 80% drawdown it must come to it as long as the trades in the live session fall within statistical expectation. I believe the capital required is calculated as the maximum drawdown plus the maximum margin required in the test period.

Makes perfect sense to me to be honest. Its how much capital you will need to to hopefully weather the storm, but if its a hurricane then you can possible lose everything. That is why its usually a good idea to go in with atleast 1.5 times the capital required for a risk loving person like myself and maybe a 5 times capital required for a risk averse person like yourself.

But remember your returns are based on the risk you are willing to take.

OK, you have put it all nicely and I can agree with most of what you wrote. You are also right about capital required calculation.

But, while reading your post, it also crossed my mind that not only we might have quite different risk tolerance, but also that we're maybe missing an important variable here. A variable that will shed new light on the whole issue. And that is how much of our savings / net worth are we actually commiting to trade forex? Allow me to explain with an example...

Let's say that both of us have $20000 of life savings and that both of us are attempting to get better return on that money, instead of leaving it in the bank and earning steady 2% per year. Somehow we both came to the conclusion that a) forex market is interesting because of it's liquidity and b) that system trading is the way. So far so good.

Now let's see where we might diverge slightly in approach and thus create an illusion that we have different risk tolerance, when there might be none.

You might say, this forex market is dangerous, I'm afraid of it, so I'll commit only $4000 of my life savings to trade forex. You leave the rest in the bank. On the other hand, because you now stand to lose max 20% of everything, in the worst case, you can actually be very courageous and thus you're willing to see even 60-80% drawdowns, because, hey, you can never lose more than 20%. Right?

Me, on the other hand, I might look conservative, but actually my approach is a bit different, which leads to a wrong conclusion. From the begining, and currently just playing with demo account, I'm pretending that I'm already trading with all of my life savings. So I play from the beginning like I have invested all of $20000 I have.

Now, to match our risk tolerance, we would need to include all those parameters in the calculation. At the time that your $4000 account is say 60% underwater, that is -$2400, mine should be 12% underwater (also -$2400) if we're at the same risk level. If I'm at -15%, that actually means that you're more conservative than me. Even if the numbers tell quite the different story.

So is Sundance risking $5k of $10k of his life savings, and is thus wildly adventurous, or using $5k of $500k, which his grandma left him when she died (and is thus chicken), we really don't know. No hard feelings Sundance!

These money management calculations can really be a bitch and deserves it's own topic (or another one). I'll soon open one, because I have one more thing I'd like to point out.

Posted By: Sundance

Re: Z12 trade - 01/03/14 19:20

Acid you call me chicken? :-)

I know that I risk to much but I see so less trades I raised the values.

When I loose the 5000€ my wife will kill me but nothing more or less. I have my fonds running. Those 5000 bucks are money I can 'play' with...

Posted By: Anonymous

Re: Z12 trade - 01/03/14 20:04

Acid you call me chicken? :-)

I know that I risk to much but I see so less trades I raised the values.

Ha ha ha, I see you!

When I loose the 5000€ my wife will kill me but nothing more or less. I have my fonds running. Those 5000 bucks are money I can 'play' with...

Oops. Still, read my topic about undercapitalization. I'd like to see you around for much longer.

Posted By: Sundance

Re: Z12 trade - 01/03/14 20:40

I already read it. I'am not that certain if I really should lower the margin more. I think then Z12 won't take any more trades...

Posted By: DMB

Re: Z12 trade - 01/03/14 21:12

@Acidburn - I do not know anyone who has made money with robot trading. I have read Market Wizards and there are people there who have, apparently. Larry Williams would use software and mechanical rules but still placed his trades manually after a little discretionary input. And I have read about those HFT computers sitting beside the exchanges. But robot trading like us, I know of no one, let alone someone who's real results were better than backtested. No one on this forum has come forward and said 'yes, I am making money with what I have coded or with the Zs, that is reliable.'

Also, it is clearly stated in the manual, somewhere, that to have a 'steady income' you need in the order of ten algos across ten symbols, give or take. With Z3, Z5, Z12 I would expect I have this. But my three months of trading and the demo's six months of trading are, in my opinion, failing with this objective. The flat period is clearly longer than the backtested one (some 20 weeks depending on the version of Zorro.) The exception is Z5 which some of us feel uncomfortable trading (I know discomfort is good, but grid trading?)

Also, I am like that second guy. I have my life savings. I have an overall passive income I would like to get from it (to fit my Asia living plan) and I am willing to take a higher risk on a small proportion of it so that the overall return meets my objective. I agree that it fits into a bigger picture and each individual must frame it based on their objectives, current situation and risk appetite.

Finally, I can give the Zs six more months, but not with real money. And if someone tells me that the results are within statistical boundaries, but they are not willing to show me the actual numbers, then I can't believe them, at least not with real money.

I usually give things a little more slack than they deserve, or give them too much the 'benefit of the doubt.' But this is stretching my patience.

Posted By: Anonymous

Re: Z12 trade - 01/03/14 21:23

Well I have asked for myfxbook verified stats for the accounts and it has been overlooked countless times... Verification of the claim comes down to us

Posted By: DMB

Re: Z12 trade - 01/03/14 21:40

@Liftoff - There is one tendency that is almost universal. Once you become a successful trader, you leave the noobs community and don't feel a need to publish your results. Then you become a myth, like so-and-so's brother-in-law trades for a living. Even the one's who do stay public, e.g. through education, don't publish their results. So I won't be surprised if the Zorro team keep their official and personal results to themselves. With other educators, I have even asked for a results file without the lot size and account balance. Just the date/time, entry, exit (and pleaded for initial stop for risk calcs) but they don't share. Such attachment, such ownership and such pride. It almost contradicts the equanimous state of being required to handle trading's ups and down.

Posted By: Anonymous

Re: Z12 trade - 01/03/14 21:48

so dont put your trust in others. Write your own scripts and work them

Posted By: Anonymous

Re: Z12 trade - 01/03/14 21:49

Very interesting writeup DMB. I have also heard of noone who systematically earns money from algorithmic trading. And also have seen many failures, actually too many to count.

Yet, there's so much beauty and creativity in the process of developement of automated strategies, that I still feel like I'm at the beggining of the trip and have still a lot to learn before I can fusion all those important bits and produce my first profitable strategy, one that I would finally trust to trade with real money. Obviously, it's also a very time consuming process, and that I believe is the main obstacle on the road. While professional quants receive their salary, so they can concentrate on the important things most of the day, most of us are approaching this as a hobby (i.e. an hour or two a day, on the average). We do have big plans for the future, of course, but a quite distant future, I'm afraid.

I understand you're dissapointed with Z's performance, and I'm too, but I decided just today to give 'em some more months, based on new discoveries. That jcl won't reveal his performance is telling, I agree.

But as I already replied privately, I see bigger value in Zorro itself, as a development platform, than in Z's, because honestly, I think I could never fully trust black box with real money. Yes, if Z's were performing very good, I would probably trust them with some small amount (chicken :)), but so far there's no evidence it would've been a great move.

So, I'll continue running the demo for the indefinite time, but my primary interest will continue to be additional education and research, and for that I love Zorro.

Posted By: DMB

Re: Z12 trade - 01/04/14 05:03

@Acidburn - Thanks for keeping the demo up for the indefinite period. I do hope Zs prove themselves with more time. Zorro is great software. I wish I had it 10 years ago when I was first programming Larry Williams' stuff (not that the Oops! pattern is relevant any more.)

Of course I want to create my own stuff and not rely on the Zs. It's a great creative outlet. But with only a few spare hours each day, there is only so much time I can put into this.

Posted By: Anonymous

Re: Z12 trade - 01/04/14 09:03

@Acidburn have you considered running dusktraders script for a couple of months. He made it available to the community and it seems like a good system to put on the test lab.

Posted By: Anonymous

Re: Z12 trade - 01/04/14 10:27

@Acidburn have you considered running dusktraders script for a couple of months. He made it available to the community and it seems like a good system to put on the test lab.

Yes, I have considered it. Dusktraders work is, together with lots of other stuff, on my longish todo list. I took a bit of a creative pause last few months with intention to now catchup in the next few weeks. No, it's not a NY resolution, because those typicially fail, it's a coincidence that I reactivated right at the beginning of 2014.

But, here's a trouble. Running multiple OS-es takes resources. I have only one slot remaining for my own work. So, to demo dusktrader's or any other nice strategy, I would need to kill something already running. Last few weeks I wasn't looking nicely at Z12 and was contemplating the idea of replacing it with dusktrader's strategy. Now, I'm not so sure, I'd like to give Z12 some more time to see if it can recover.

I wonder if anybody else has the resources to run other strategies? I wonder have I missed some more efficient way to run multiple Zorro's (anybody using Wine here, or ReactOS, how's it going?). It would be so much easier if Zorro allowed multiple connections to the broker, but...

Posted By: Anonymous

Re: Z12 trade - 01/04/14 11:12

@Acidburn, perfectly understand you. If I am able to land a job this month, I am sure I can have a setup by March to help test some of these strategies.

Good to hear your interest has been rekindled.

Posted By: Sundance

Re: Z12 trade - 01/08/14 07:22

Hi jcl,

I think I have a problem with my Z12 instance. When you look at my Z12 link at myfxbook (signature) you can see that there are less trades. Compared to acids Z12 demo, where he has many trades, I'am asking myself if there is a prob with my Z12 instance. The Zorro info panel doesn't show anything important:

--------------------------------

[Mon 06.01. 08:07] 4381 -563 +0

[Mon 06.01. 12:07] 4381 -563 +0

[Mon 06.01. 16:07] 4381 -563 +0

[Mon 06.01. 20:07] 4381 -563 +0

[Tue 07.01. 00:07] 4381 -563 +0

[Tue 07.01. 04:07] 4381 -563 +0

[Tue 07.01. 08:07] 4381 -563 +0

[Tue 07.01. 12:07] 4381 -563 +0

[Tue 07.01. 16:07] 4381 -563 +0

[Tue 07.01. 20:07] 4381 -563 +0

[Wed 08.01. 00:07] 4381 -563 +0

[Wed 08.01. 04:07] 4381 -563 +0

--------------------------------

'I set my sliders to:

Margin: 60

Risk: 20

Z.ini contains:

NFA = 0

FXOnly = 0

MMax = 100

Phantom = 0

Comma = 0

Mute = 0

Weekend = 2

Verbose = 2

BrokerPatch = 0

Preload = 0

Thanks in advance

Posted By: jcl

Re: Z12 trade - 01/08/14 08:58

Your Z12 should normally have placed trades in the last 2 days. At least we had trades with our Z12 versions. Risk 20 is even a little high, we're trading with Risk 10.

Have you excluded some assets from the portfolio? Are you trading with the most recent version and parameter set?

Posted By: Sundance

Re: Z12 trade - 01/08/14 13:39

Hi jcl,

I changed the Risk from 10 to 20 last week. I restarted the Amazon VPS and now I have a AUDUSD trade running with 0.06 lot . *LOL*

So I will change it back to Risk 10 now. I will post again when I have a new trade!?

Thanks jcl!

Posted By: Sundance

Re: Z12 trade - 01/08/14 13:42

Little update: Zorro says

(AUD/USD:LP:S) Short 6@0.8930 Entry limit

[AUD/USD:LP:S4330] Short 6@0.8929 Risk 24 ts

What does Rsik 24 ts mean? ts?

Posted By: jcl

Re: Z12 trade - 01/08/14 15:27

Risk 24 means that this trade can lose up to ~24 EUR, and "ts" means "trailing stop".

->

http://manual.zorro-trader.com/trading.htm

Posted By: Sundance

Re: Z12 trade - 01/08/14 15:45

Oh. Sorry I overlooked this. I never saw the ts and thougth it would mean 'thousand' :-)

The risk is then very low. 24€. Mmmhhhh.

Posted By: DdlV

Re: Z12 trade - 01/08/14 16:39

Hi Sundance,

The s is Stop and the t is Trailing. Got me too the first time I saw it, but it's in the manual...

Hi all,

As some of you know, I've been demo-ing z12s since last May. For much of that time they have been on phantom, but initially for a month or 2 they were not. I also recently removed phantom on upgrading to 1.2 as both were healthily in profit Not sure that was wise, but I am testing!

1) FXCM demo spreadbetting account / z12 / started with 50k / margin 50 Risk 10.

Current Balance: 50,616

Current Equity: 50,517

Lowest Balance: 47,000 approx

Max Balance: 51,600 approx

This was a bit of a rollercoaster, but calmed down when I put phantom=1. Not good over Dec. I'd never have put 50k in but I'd be relatively happy on 1.5k over an 8 month period if I did have 10k down.

2) Alpari demo spreadbetting account via MT4 bridge / FX only as commodities and indices are futures / z12 / started with 10k - margin 50 Risk 10.

Mostly on phantom only moved off phantom at 1.20. Worst period of drawdown has been last 6 weeks or so, possibly related to removing phantom until then it was very smooth.

Current Balance: 12,543

Current Equity: 12,597

Lowest Balance: 9,900 approx.

Max Balance: 13,600 approx.

This installation has given me exactly zero problems compared to the FXCM API where I've had issues of can't close and the persistently annoying equity display.

@acidburn - 2.5k on 10k in 8 months would make me very happy on an automated system :-)

BTW At end of year my discretionary trading was up 41.5%. I'm very, very happy with that, even with a peak to trough drawdown of 15.5% (numerator was $drawdown denominator was peak balance). I usually trade at 0.5, 1, 1.5 or max 2% risk of my opening balance each quarter, so I'm very traditional in my risk management and lot sizing.

I have been learning from zorro however, and recently analysed my performance as if I had been using phantom trading of my own equity curve as a discretionary trader. I would have increased my return to 88.4%!!!!! If I can do that in 2014, its bye bye day job!! Now for the discipline to sit on my hands and paper trade when I'm out of synch with the markets!

Posted By: Sundance

Re: Z12 trade - 01/11/14 08:10

Hi swingtrader,

thanks for your post. So what do you think? Should I enable Phantom trades on my Z12 account or not. I'am not that convinced...

Considering you have real money invested I'm uncomfortable giving advice, but I'll happily tell you what I'm doing with my demos.

I'm going to give them some time off phantom to see how they do.

My initial logic was no phantom as it reduces overall profitability, but I was not comfortable with the drawdowns using my logic at the time. I then decided to enable phantom to see if the balance could build up. It has, so now I'm back with phantom off.

For me it is too early to say definitely phantom on or off with the z12 robots because they are trading for income, using optf for position size and without reinvesting of profits. I'm still testing.

I'm sure it is of benefit for my discretionary trading for capital gain, using % balance risk per trade i.e. reinvestment of profits. Discretionary traders always go through periods of being out of touch with the markets, the phantom mechanism would have kept me out of the market entirely in those phases, leaving me much less drawdown to trade my way out of to get to growth again.

This might make more sense in context of my post in this thread:

http://www.opserver.de/ubb7/ubbthreads.php?ubb=showflat&Number=425296&page=19

Posted By: Sundance

Re: Z12 trade - 01/16/14 15:32

Hi swing,

thanks for your answer!!

sincerely yours

Sundance

Posted By: Sundance

Re: Z12 trade - 03/28/14 19:22

@jcl:

1. Can you tell me when the next Zorro Version will arrive?

2. Can you confirm the last two trades my Z12 real account does?

(BUY NAS100 and BUY US30).

Thanks in advance

Sundance

Posted By: jcl

Re: Z12 trade - 03/31/14 11:24

Zorro 1.22 is ready, we're just generating new parameters for the Z systems and doing some final tests. I think it will be released to the beta forum by the end of this week, or next week the latest.

The last 3 trades from my Z12 instance have been SPX500, US30, and USD/JPY, all long.

Posted By: Sundance

Re: Z12 trade - 03/31/14 12:06

Thanks for the info jcl. Nice to see further improvements.

I have no error messages from my Z12 Zorro instance. Why are there different trades to yours?

I will also check if there has been any differences in the config files.

Posted By: jcl

Re: Z12 trade - 03/31/14 13:32

All Z systems trade slightly differently due to a random element, f.i. shifting thresholds by a small random value. In most cases this causes a trade to be opened at a different bar, sometimes not at all. There is no error message about that as long as no error is involved.

Posted By: Sundance

Re: Z12 trade - 03/31/14 16:27

Ah. Thanks. I knew that there is a difference when a trade will be taken but not that because of that difference a trade sometimes won't be taken. Good to know.

Posted By: Sundance

Re: Z12 trade - 04/10/14 17:06

I think I'am done with Z12. It nearly reaches a loss of 5000€. This is the maximum DD the backtest gave me. So I think that Z12 is out of date.

What do you think jcl?

Hi Sundance,

have a look at my fxcm z12 demo. It seems remarkably different. Not sure what's goign on there. (note: because of some account messing, only the profit tab is worth viewing, but you should also get the list of trades.

Are you using phantom =1?

Posted By: Sundance

Re: Z12 trade - 04/10/14 18:19

Hi swing,

these are my setting:

NFA = 0

FXOnly = 0

MMax = 100

Phantom = 0

Comma = 0

Mute = 0

Weekend = 2

Verbose = 2

BrokerPatch = 0

Preload = 0

I really want to know how that can be so different. I now set the risk slider to 0. Till I'am 100% sure everything is okay I won't trade it any further...

Posted By: Sundance

Re: Z12 trade - 04/10/14 18:38

I think I know the difference. You have set the FXonly setting I guess!?

On my side I have US30,SPX500 and NAS100 trades which did the most damage.

Posted By: Sundance

Re: Z12 trade - 04/10/14 19:25

Okay. Don't say anything. Your myfx account named 'SpreadBettingz12FXonly' says it all. I think I'am gonna also set FXOnly to 1.

No the FXCM account is full z12 currently with phantom = 0.

It had been phantom 1 until december, but since then it is phantom = 0.

It also has the default slider settings of 50/10Check if your risk/margin settings are suitable for those instruments, as their min lot sizes can be high, leading to lumpier trade sizes.

To be fair US30, SPX and NAS have been very difficult to trade in that period, they've hit my discretionary trading pretty hard too.

for info the spreadbetting fx only account has phantom =1 from the start.

Posted By: Sundance

Re: Z12 trade - 04/10/14 20:07

Okay. Looked at the wrong account. Now I see. It's really a mess. Hope that market is going to behave different in not such a distant future.