Posted By: StefanCGN

Going live with my portfolio - 02/22/20 11:04

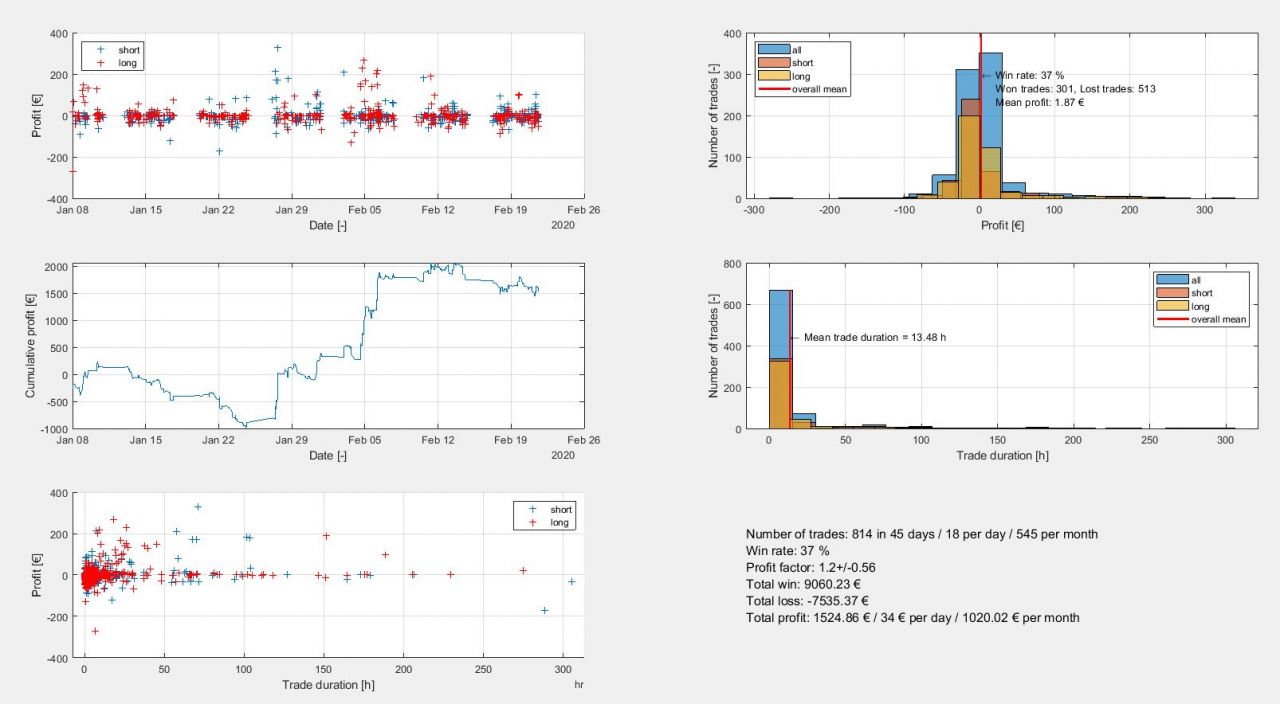

Hi all, attached you find the status of my first live portfolio system after a few hundred trades. It's a portfolio consisting of 10 different versions of cycle-, trend-, cluster-, countertrend- and season algos combined with 20 assets. It uses 1h to 4h bars in my OANDA account. Each algo was tests for some weeks succesfully on a demo account. The portfolio was backtested with a sharp ratio of ~3. Although only a few weeks online it created some profit (initial capital 4k).

- Thank you JCL for providing such a cool tool and all the knowledge sharing! Also thanks to everybody who answered all my newbie questions :-)

- During my developmet work i was never able to reproduce winrates like the benchmark Z-systems have. I always had <40%. Meaning, my success is depending on a few big wins, that can be seen in my attached statistics. Is that something to worry about?

- I have algo performing very well so far and others generating minor losses. When (and based on what) do you typically decide when to take out an algo out of your portfolio or minimize it's margin?

- Any comments or suggestions how to improve?

If anybody is interested in my MATLAB tool that takes trade.csv and generates this nice pictures.... feel free to ask.

- Thank you JCL for providing such a cool tool and all the knowledge sharing! Also thanks to everybody who answered all my newbie questions :-)

- During my developmet work i was never able to reproduce winrates like the benchmark Z-systems have. I always had <40%. Meaning, my success is depending on a few big wins, that can be seen in my attached statistics. Is that something to worry about?

- I have algo performing very well so far and others generating minor losses. When (and based on what) do you typically decide when to take out an algo out of your portfolio or minimize it's margin?

- Any comments or suggestions how to improve?

If anybody is interested in my MATLAB tool that takes trade.csv and generates this nice pictures.... feel free to ask.