|

1 registered members (AndrewAMD),

552

guests, and 1

spider. |

|

Key:

Admin,

Global Mod,

Mod

|

|

|

Re: My Take on A Mega Script

[Re: ]

#434706

Re: My Take on A Mega Script

[Re: ]

#434706

12/24/13 15:25

12/24/13 15:25

|

liftoff

Unregistered

|

liftoff

Unregistered

|

So we pick up from where we left of yesterday. I went over the process again and I seem to have propped up the average return to 47%. The current code stands as follows.

function fridayClose(int fridayclose)

{

//allows Friday trading up until NYSE 3pm; close trades and don't allow after this

if(fridayclose && dow() == FRIDAY && lhour(ET) >= 15)

{

exitLong("*");

exitShort("*");

return 1; //condition met; indicate no further trades

}

return 0; //condition not met; safe to take new trades

}

function hourOpen(int hourblockstart, int hourblockend)

{

//blocks new open trades between selected hours

//uses NYSE time, including DST

if ( (lhour(ET) >= hourblockstart) && (lhour(ET) < hourblockend) )

return 0; //between blocked hours, do not allow trade opens

else

return 1; //no conditions met, allow trades by default

}

function todayOpenCombo(var dayopencombo)

{

//allows optimizer to specify the best combo of days for opens

//bit position 0 = Monday

//bit position 1 = Tuesday

//bit position 2 = Wednesday

//bit position 3 = Thursday

//bit position 4 = Friday

//bit position 5 = Sunday

//given a combination #, the function will return whether

//current dow() is in the combination

int dayopencombobits = dayopencombo+.5; //truncate to rounded int

int today = dow() - 1; //Mon is 0

if (today == 6) today = 5; //bump Sun to 5 (no Sat, keep binary range 0-63)

if (dayopencombobits & (1 << today)) return 1; //current dow() is in the combo

else return 0; //current dow() not in combo, do not allow trade opens

}

function todayCloseCombo(var dayclosecombo)

{

//allows optimizer to specify the best combo of days to close by NYSE 4pm

//bit position 0 = Monday

//bit position 1 = Tuesday

//bit position 2 = Wednesday

//bit position 3 = Thursday

//bit position 4 = Friday

//bit position 5 = Sunday

//given a combination #, the function will determine if we are beyond

//a combo close time, close all trades if necessary, and return 1

//if no further trades allowed today

int dayclosecombobits = dayclosecombo+.5; //truncate to rounded int

int today = dow() - 1; //Mon is 0

if (today == 6) today = 5; //bump Sun to 5 (no Sat, keep binary range 0-63)

if ((dayclosecombobits & (1 << today)) && lhour(ET) >= 16)

{

exitLong("*");

exitShort("*");

return 1; //current dow() is in the combo; indicate no further trades

}

else return 0; //current dow() not in combo, safe to take new trades

}

function marketOpenCombo(var marketopencombo)

{

//allows optimizer to specify best markets to initiate trades

//bit position 0 = New York 8am-5pm Eastern

//bit position 1 = Sydney 5pm-2am Eastern

//bit position 2 = Tokyo 7pm-4am Eastern

//bit position 3 = London 3am-12pm Eastern

//given a combination #, the function will determine if current time is within

//a market part of the combination (returns 1 to allow trading if true)

int marketcombobits = marketopencombo+.5; //truncate to rounded int

if ( (lhour(ET) >=8) && (lhour(ET) <17) && (marketcombobits & (1 << 0)) ) return 1; //inside New York

if ( (lhour(ET) >=17) || (lhour(ET) <2) && (marketcombobits & (1 << 1)) ) return 1; //inside Sydney

if ( (lhour(ET) >=19) || (lhour(ET) <4) && (marketcombobits & (1 << 2)) ) return 1; //inside Tokyo

if ( (lhour(ET) >=3) && (lhour(ET) <12) && (marketcombobits & (1 << 3)) ) return 1; //inside London

return 0; //default - current market not in combination, don't allow trade opens

}

function checkModifiers()

{

int reversedir = 0; //default normal trade direction (0) unless specified otherwise

int fridayclose = 0; //enforce auto-close and no trades after NYSE 3pm Friday

int hourblockstart = 0; //block trade opens beginning at NY hour

int hourblockend = 0; //block trade opens ending at NY hour

int dayopencombo = optimize(61,1,63,1); //combo of days to open; 63=every day

int dayclosecombo = optimize(29,1,63,1); //combo of days to close after NYSE 4pm; 0=none; 63=every day

int marketopencombo = optimize(13,1,15,1); //combo of markets to allow trade opens; 15=every market

if ( (!fridayClose(fridayclose) //close NYSE 3pm on Friday

|| !todayCloseCombo(dayclosecombo) ) //close NYSE 4pm on selected days

&& todayOpenCombo(dayopencombo) //open on selected days only

&& marketOpenCombo(marketopencombo) //open during selected markets only

&& hourOpen(hourblockstart,hourblockend) ) //open during selected hours only

return 1; //ok to place new trades

else

return 0; //no trade, restricted by a modifier

}

function run()

{

//Parameters

set(PARAMETERS);

StartDate = 20080101;

EndDate = 20131220;

BarPeriod = 60; //optimize(60,60,1440,60);

if(is(TESTMODE)) NumSampleCycles = 6; //oversampling on Test only, not Train

if (Train) { RollLong = 0; RollShort = 0; } //help prevent asymmetry in parameters & profit factors

DataSplit = 70; //70% training, 30% OOS test

NumWFOCycles = 5;

int maxtrades = 1;

// require minimum 30 trades per WFO cycle or stop training

static int LastWFOCycle = 0, LastNumTrades = 0;

if(Train && (WFOCycle != LastWFOCycle) )

{

if(LastNumTrades > 0 and LastNumTrades < 30)

{

char tradecount[100];

sprintf(tradecount,"Not enough trades per cycle: %d",LastNumTrades);

quit(tradecount);

}

LastWFOCycle = WFOCycle;

}

LastNumTrades = NumWinTotal+NumLossTotal;

//edge trading logic

var BarsPassed = optimize(820,300,1300, 10);

vars Price = series(price());

vars Trend = series(LowPass(Price,BarsPassed));

Stop = ATR(100)* optimize(3,1,6,1,-3);

if (checkModifiers())

{

if(valley(Trend))

reverseLong(maxtrades);

else if(peak(Trend))

reverseShort(maxtrades);

}

}

So I continue with the other steps. Step 1g: Goal: determine if equity-curve trading would be helpfulYes WFO; Yes oversample; Yes maxtrades; Yes all param optimizing; Yes best modifier(s); Yes emodeso as dusktrader advices, I will uncomment, train and test each one of the emodes. For this strategy, emode 1 and emode 3 produce 109%, so I went with emode 1. Step 2a: Goal: simulate actual margin and/or reinvestmentYes rolling WFO; Yes oversample; Yes maxtrades; Yes all param optimizing; Yes modifier(s); Yes emode; Yes reinvestSo this step involves using optf to mathematically determine how good the bot has become. With this numeric evaluation, we can be more objective in comparing it to our other strategies. So we first set the FACTOR flag on for calculating the optf figure We move from single lots to lots based on an account figure from now on. Meaning our margin is determined in relation to our starting capital. We are however not compounding. The following code section lives just above the "edge trading logic" section:

//reinvest a portion of profits

int reinvestprofits = 0; //invoke margin setting during trade logic

Margin = 0; //default

var MarginLong = 0; //default

var MarginShort = 0; //default

if (reinvestprofits)

{

Capital = 1000; //simulated account balance

var riskCapital = 900; //basis to trade with

if (OptimalF>.001) //profitable as compared to other assets

{

MarginLong = OptimalFLong * riskCapital;

MarginShort = OptimalFShort * riskCapital;

}

}

And then just before our trade entry commands, I place this code:

if (reinvestprofits && MarginLong>0) Margin = MarginLong; else if(is(TRADEMODE)) Lots = -1;

if (reinvestprofits && MarginShort>0) Margin = MarginShort; else if(is(TRADEMODE)) Lots = -1;

So I train the strategy with reinvestment turned to 0 and turn it to true (1) and test the strategy.  The number of trades are really low. I have no idea why but I am guessing it has something to do with my code. Hopefully as I better grasp coding I can come back to this and find what is wrong. Step 3a: Goal: identify best assetsYes WFO; Yes oversample; Yes maxtrades; Yes all param optimizing; Yes best modifier(s); Yes emode; No reinvestAt this point I add other assets to the strategy. I was looking to add AUDUSD and NZDUSD but NZDUSD did not have the minimum 30 trades, so I set it aside and focused on EURUSD and AUDUSD. I turned reinvestment off, trained and tested.

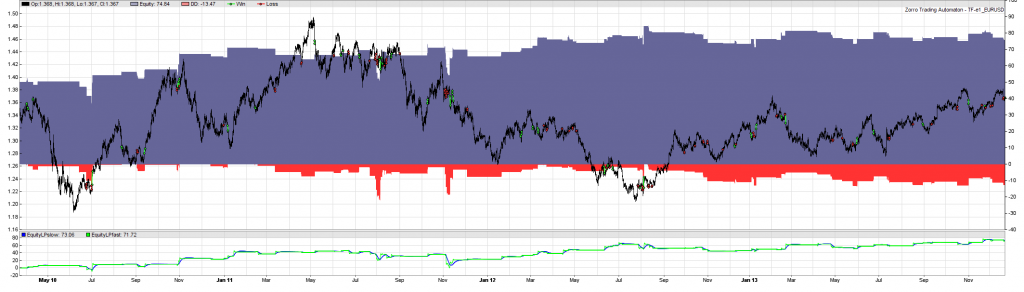

Walk-Forward Test: TF-e1 portfolio 2008..2013

Can't open TF-e1.fac (rt)

Read TF-e1_1.par TF-e1_2.par TF-e1_3.par TF-e1_4.par

Profit 17$ MI 0$ DD 33$ Capital 39$

Trades 156 Win 44% Avg +1.4p Bars 7

AR 15% PF 1.09 SR 0.22 UI 118.0% Error 53%

With such a huge UI and error term, I have surely done something wrong. Step 3bYes WFO; Yes oversample; Yes maxtrades; Yes all param optimizing; Yes best modifier(s); Yes emode; Yes reinvest; Yes multi-asset loopSo at this point I turn on reinvestment and test.

TF-e1 compiling................

Walk-Forward Test: TF-e1 portfolio 2008..2013

Can't open TF-e1.fac (rt)

Read TF-e1_1.par TF-e1_2.par TF-e1_3.par TF-e1_4.par

Profit 17$ MI 0$ DD 33$ Capital 48$

Trades 156 Win 44% Avg +1.4p Bars 7

CAGR 8% PF 1.09 SR 0.20 UI 118.0% Error 53%

I have definitely done a lot wrong along the way with such a huge Ulcer and error. This is the code I ended up with.

function fridayClose(int fridayclose)

{

//allows Friday trading up until NYSE 3pm; close trades and don't allow after this

if(fridayclose && dow() == FRIDAY && lhour(ET) >= 15)

{

exitLong("*");

exitShort("*");

return 1; //condition met; indicate no further trades

}

return 0; //condition not met; safe to take new trades

}

function hourOpen(int hourblockstart, int hourblockend)

{

//blocks new open trades between selected hours

//uses NYSE time, including DST

if ( (lhour(ET) >= hourblockstart) && (lhour(ET) < hourblockend) )

return 0; //between blocked hours, do not allow trade opens

else

return 1; //no conditions met, allow trades by default

}

function todayOpenCombo(var dayopencombo)

{

//allows optimizer to specify the best combo of days for opens

//bit position 0 = Monday

//bit position 1 = Tuesday

//bit position 2 = Wednesday

//bit position 3 = Thursday

//bit position 4 = Friday

//bit position 5 = Sunday

//given a combination #, the function will return whether

//current dow() is in the combination

int dayopencombobits = dayopencombo+.5; //truncate to rounded int

int today = dow() - 1; //Mon is 0

if (today == 6) today = 5; //bump Sun to 5 (no Sat, keep binary range 0-63)

if (dayopencombobits & (1 << today)) return 1; //current dow() is in the combo

else return 0; //current dow() not in combo, do not allow trade opens

}

function todayCloseCombo(var dayclosecombo)

{

//allows optimizer to specify the best combo of days to close by NYSE 4pm

//bit position 0 = Monday

//bit position 1 = Tuesday

//bit position 2 = Wednesday

//bit position 3 = Thursday

//bit position 4 = Friday

//bit position 5 = Sunday

//given a combination #, the function will determine if we are beyond

//a combo close time, close all trades if necessary, and return 1

//if no further trades allowed today

int dayclosecombobits = dayclosecombo+.5; //truncate to rounded int

int today = dow() - 1; //Mon is 0

if (today == 6) today = 5; //bump Sun to 5 (no Sat, keep binary range 0-63)

if ((dayclosecombobits & (1 << today)) && lhour(ET) >= 16)

{

exitLong("*");

exitShort("*");

return 1; //current dow() is in the combo; indicate no further trades

}

else return 0; //current dow() not in combo, safe to take new trades

}

function marketOpenCombo(var marketopencombo)

{

//allows optimizer to specify best markets to initiate trades

//bit position 0 = New York 8am-5pm Eastern

//bit position 1 = Sydney 5pm-2am Eastern

//bit position 2 = Tokyo 7pm-4am Eastern

//bit position 3 = London 3am-12pm Eastern

//given a combination #, the function will determine if current time is within

//a market part of the combination (returns 1 to allow trading if true)

int marketcombobits = marketopencombo+.5; //truncate to rounded int

if ( (lhour(ET) >=8) && (lhour(ET) <17) && (marketcombobits & (1 << 0)) ) return 1; //inside New York

if ( (lhour(ET) >=17) || (lhour(ET) <2) && (marketcombobits & (1 << 1)) ) return 1; //inside Sydney

if ( (lhour(ET) >=19) || (lhour(ET) <4) && (marketcombobits & (1 << 2)) ) return 1; //inside Tokyo

if ( (lhour(ET) >=3) && (lhour(ET) <12) && (marketcombobits & (1 << 3)) ) return 1; //inside London

return 0; //default - current market not in combination, don't allow trade opens

}

function checkModifiers()

{

int reversedir = 0; //default normal trade direction (0) unless specified otherwise

int fridayclose = 0; //enforce auto-close and no trades after NYSE 3pm Friday

int hourblockstart = 0; //block trade opens beginning at NY hour

int hourblockend = 0; //block trade opens ending at NY hour

int dayopencombo = optimize(61,1,63,1); //combo of days to open; 63=every day

int dayclosecombo = optimize(29,1,63,1); //combo of days to close after NYSE 4pm; 0=none; 63=every day

int marketopencombo = optimize(13,1,15,1); //combo of markets to allow trade opens; 15=every market

if ( (!fridayClose(fridayclose) //close NYSE 3pm on Friday

|| !todayCloseCombo(dayclosecombo) ) //close NYSE 4pm on selected days

&& todayOpenCombo(dayopencombo) //open on selected days only

&& marketOpenCombo(marketopencombo) //open during selected markets only

&& hourOpen(hourblockstart,hourblockend) ) //open during selected hours only

return 1; //ok to place new trades

else

return 0; //no trade, restricted by a modifier

}

function checkEquity(var emode)

{

//emode 1 = standard: sets phantom/normal mode only (via Lots)

//emode 2 = switch hitter: always in market (Lots=1), fades direction (via dir)

//emode 3 = reward success with weighting: increase trades based on degree of improvement

//emode 4 = mean reversion: trade when equity curve falls (Lots=1), sit out when it rises (Lots=-1)

vars EquityCurve = series(EquityLong+EquityShort); //includes all phantom equity

var dir; //indicates normal trade direction (dir=1) or reverse (dir=-1)

//narrower curves

//var slow = 50;

//var fast = 10;

//wider curves

//var slow = 100;

//var fast = 10;

//mega-wide curves

var slow = 200;

var fast = 10;

//uber-wide curves

//var slow = 300;

//var fast = 10;

//optimized curves

//var slow = optimize(50,50,300,12);

//var fast = 10;

vars EquityLP = series(LowPass(EquityCurve,fast));

var EquityLPfalling = LowPass(EquityLP,slow);

var EquityLPrisingBigger = LowPass(EquityLP,slow*3.2);

var EquityLPrisingBig = LowPass(EquityLP,slow*1.5);

plot("EquityLPslow",LowPass(EquityLP,slow),1,BLUE);

plot("EquityLPfast",LowPass(EquityLP,fast),0,GREEN);

if(EquityLP[0] < EquityLPfalling && falling(EquityLP)) { //drawdown

if (emode==1) Lots = -1; //set phantom trade mode

if (emode==2) return 1; //fade: take signals when losing

if (emode==3) { //reward success with weighting

Lots = -1; //set phantom trade mode

return 1; //allow max 1 phantom trade in drawdown

}

if (emode==4) Lots = 1; //mean-reversion: start trading when equity curve falls

}

else { //positive equity curve

if (emode==1) Lots = 1; //set normal trade mode

if (emode==2) return -1; //fade: take reverse signals when winning

if (emode==3) { //reward success with weighting

Lots = 1; //set normal trade mode

if (EquityLP[0] > EquityLPrisingBigger && rising(EquityLP)) return 3; //very big rising

else if (EquityLP[0] > EquityLPrisingBig && rising(EquityLP)) return 2; //big rising

else return 1; //rising but not yet significantly

}

if (emode==4) Lots = -1; //mean-reversion: stop trading when equity curve rises

}

}

function run()

{

//Parameters

set(PARAMETERS+FACTORS);

StartDate = 20080101;

EndDate = 20131220;

BarPeriod = 60; //optimize(60,60,1440,60);

LookBack = 600;

if(is(TESTMODE)) NumSampleCycles = 6; //oversampling on Test only, not Train

if (Train) { RollLong = 0; RollShort = 0; } //help prevent asymmetry in parameters & profit factors

DataSplit = 70; //70% training, 30% OOS test

NumWFOCycles = 5;

int maxtrades = 1;

// require minimum 30 trades per WFO cycle or stop training

static int LastWFOCycle = 0, LastNumTrades = 0;

if(Train && (WFOCycle != LastWFOCycle) )

{

if(LastNumTrades > 0 and LastNumTrades < 30)

{

char tradecount[100];

sprintf(tradecount,"Not enough trades per cycle: %d",LastNumTrades);

quit(tradecount);

}

LastWFOCycle = WFOCycle;

}

LastNumTrades = NumWinTotal+NumLossTotal;

//equity-curve trading

checkEquity(1); //emode 1: normal/phantom trading

//reversedir = checkEquity(2); //emode 2: switch hitter

//maxtrades = checkEquity(3); //emode 3: reward success

//checkEquity(4); //emode 4: mean-reversion mode

//reinvest a portion of profits

while(asset(loop("EUR/USD","AUD/USD")))

{

int reinvestprofits = 1; //invoke margin setting during trade logic

Margin = 1; //default

var MarginLong = 0; //default

var MarginShort = 0; //default

if (reinvestprofits)

{

Capital = 50; //simulated account balance

var riskCapital = 40; //basis to trade with

if (OptimalF>.001) //profitable as compared to other assets

{

MarginLong = OptimalFLong * riskCapital;

MarginShort = OptimalFShort * riskCapital;

}

}

//edge trading logic

var BarsPassed = optimize(820,300,1300, 10);

vars Price = series(price());

vars Trend = series(LowPass(Price,BarsPassed));

Stop = ATR(100)* optimize(3,1,6,1,-3);

if (checkModifiers())

{

if(valley(Trend))

{

if (reinvestprofits && MarginLong>0) Margin = MarginLong; else if(is(TRADEMODE)) Lots = -1;

reverseLong(maxtrades);

}

else if(peak(Trend))

{

if (reinvestprofits && MarginShort>0) Margin = MarginShort; else if(is(TRADEMODE)) Lots = -1;

reverseShort(maxtrades);

}

}

}

}

I will take the time to read up on workshop 4, 5 and 6 again. Go over dusk traders modifiers and emodes and get a better understanding of them and see if I can take counter trend code in workshop 5 through the process. If you notice where I might have made mistakes, please point them out so I can learn from them.

|

|

|

Re: My Take on A Mega Script

[Re: ]

#434862

Re: My Take on A Mega Script

[Re: ]

#434862

12/28/13 18:57

12/28/13 18:57

|

liftoff

Unregistered

|

liftoff

Unregistered

|

Took a couple of days off to read and do some digging around. Looks like if I am going to find any profitable systems, I have a lot more to learn. Thankfully I have the basics of script writing in zorro down to some level. I can now identify the error of leaving out ";" ... The main reason why my first zorro adventure ended abruptly. I want to make my way through the suggested books in the first quarter of 2014. But during this period I don't want to get rusty on the script writing end so I will try taking one free system or EA out there on the web and convert it to a zorro script and see how well it fares. Since my programming skills are not that strong now, please point out logic lapses you observe in my translations.

|

|

|

Re: My Take on A Mega Script

[Re: ]

#434864

Re: My Take on A Mega Script

[Re: ]

#434864

12/28/13 19:02

12/28/13 19:02

|

liftoff

Unregistered

|

liftoff

Unregistered

|

So I tried converting a very simple straight forward EA this evening. Its called MACD Cross AUDD1. You can follow this link to download and EA and read the rules with the MetaEditor and see if I did everything the way it should be done. This is the script I came up with following the rules.

function run()

{

StartDate = 2002;

BarPeriod = 1440;

LookBack = 150;

//edge trading logic

int FastPeriod = 12;

int SlowPeriod = 26;

int SignalPeriod = 9;

vars PriceClose = series(priceClose());

MACD(PriceClose,FastPeriod,SlowPeriod,SignalPeriod);

vars MainLine = series(rMACD);

vars SignalLine = series(rMACDSignal);

vars Hist = series(rMACDHist);

Stop = 30*PIP; // simple Stop

TakeProfit = 120*PIP;

if(crossOver(SignalLine,MainLine))

enterLong();

else if(crossUnder(SignalLine,MainLine))

enterShort();

}

These are the results my testing produced.

AUDUSD D1 MACD cross compiling.................

BackTest: AUDUSD D1 MACD cross AUD/USD 2002..2013

Profit -111$ MI -1$ DD 138$ Capital 76$

Trades 233 Win 20% Avg -6.2p Bars 2

AR -14% PF 0.76 SR -0.49 UI 343.7% Error 48%

|

|

|

Re: My Take on A Mega Script

[Re: ]

#434868

Re: My Take on A Mega Script

[Re: ]

#434868

12/28/13 19:53

12/28/13 19:53

|

liftoff

Unregistered

|

liftoff

Unregistered

|

Did a little tweaking optimizing the stop and running a WFO process. The code now looks like this:

function run()

{

set(PARAMETERS);

StartDate = 2002;

BarPeriod = 1440;

LookBack = 250;

NumWFOCycles = 10;

//edge trading logic

int FastPeriod = 12;

int SlowPeriod = 26;

int SignalPeriod = 9;

vars PriceClose = series(priceClose());

MACD(PriceClose,FastPeriod,SlowPeriod,SignalPeriod);

vars MainLine = series(rMACD);

vars SignalLine = series(rMACDSignal);

vars Hist = series(rMACDHist);

Stop = ATR(100) * optimize(1.99,1,15,0.5,0); // Adaptive stop

if(crossOver(SignalLine,MainLine))

reverseLong(1);

else if(crossUnder(SignalLine,MainLine))

reverseShort(1);

if(ReTrain)

{

UpdateDays = -1;

SelectWFO = -1;

}

}

And the results are as follows.

AUDUSD D1 MACD cross run..

Profit -165$ MI -2$ DD 338$ Capital 232$

Trades 132 Win 61% Avg -16.4p Bars 13

AR -11% PF 0.86 SR -0.26 UI 223.3% Error 48%

Generate Chart - please wait... ok

My aim to go around picking simple to a little complex systems and converting them to zorro scripts. I am sure if newbies come along they will find this useful and can learn by trying to converting the strategies themselves before they look at how I went about it.

|

|

|

Re: My Take on A Mega Script

[Re: ]

#434955

Re: My Take on A Mega Script

[Re: ]

#434955

12/30/13 19:46

12/30/13 19:46

|

liftoff

Unregistered

|

liftoff

Unregistered

|

So I crossed checked the AUDUSD daily chart EA against my script by running the EA on the MT4 strategy tester and checking against the trades my script took. Looks like my script was in order and the system is just not profitable.

|

|

|

Re: My Take on A Mega Script

[Re: DMB]

#435180

Re: My Take on A Mega Script

[Re: DMB]

#435180

01/03/14 18:03

01/03/14 18:03

|

liftoff

Unregistered

|

liftoff

Unregistered

|

So I just finished going through Schaum's Outline of Theory and Problems of Statistics and I it does feel like I took a couple of things from the book. A lot of examples to help solidify theory. Now I make my way to Analysis of Financial Time Series by Ruey S. Tsay. I am sure it ll take me atleast to make my way through this one. In the meantime, I continue with my project of translating ideas and mt4 robots to help improve my programming skills. Today I will be trying to translate this mt4 robot, MACD Turbo v2.0. It was featured by Robopip and based on his tests it turned out to be profitable but he tested it over only 18 months, not long enough for me. So the mt4 code is as follows;

//+------------------------------------------------------------------+

//|�������������������������������������������� MACD Turbo v2.0a.mq4 |

//|��������������������������������������for GBPUSD H1 re-coded 2013 |

//|������������������������������������������������ Free EA based on |

//|������������������������������������������������������������������|

//|��������������������������������������������������MACD Sample.mq4 |

//|����������������������Copyright � 2005, MetaQuotes Software Corp. |

//|�������������������������������������� http://www.metaquotes.net/ |

//|������������������������������������������������������������������|

//|�������������������������������� MACD Sample - Turbo v1.0 to v2.0 |

//|������������������������������ by XeroFX - http://www.xerofx.com/ |

//|������������������������������������������������������������������|

//|���������������������������������������� MACD Sample - Turbo v1.1 |

//|��������������������������������������re-coded by Tjipke de Vries |

//|������������������������������������������������������������������|

//| Free Sample Code. We disclaim all copyright interest. Thank you. |

//+------------------------------------------------------------------+

#property copyright "Copyleft - Free Sample Code - www.xerofx.com/free-ea.html - We disclaim all copyright interest."

extern string s1 = "== Basic Settings ==";

extern double StopLoss = 255;

extern double TakeProfit = 100;

extern double TrailingStop = 25;

extern double TrailingStep = 5;

extern string s2 = "== Trade Lots Size ==";

extern double Lots = 0.1;

extern string s3 = "== Signal Logic ==";

extern double MACDOpenLevel = 3;

extern double MACDCloseLevel = 2;

extern double MATrendPeriod = 24;

extern string s4 = "== Time Filters == ";

extern string UseTradingHours = "Time Control ( 1 = True, 0 = False )";

extern int����TimeControl = 1;

extern string TimeZone = "Adjust ServerTimeZone if Required";

extern int����ServerTimeZone = 0;

extern string TradingTimes = "HourStopGMT > HourStartGMT";

extern int����HourStartGMT = 8;

extern int����HourStopGMT = 20;

extern string DontTradeFriday = "Dont Trade After FridayFinalHourGMT";

extern bool�� UseFridayFinalTradeTime = TRUE;

extern int����FridayFinalHourGMT = 6;

extern string s5 = "== Extra Settings ==";

extern int����Slippage = 3;

extern double MaxSpread = 4.0;

extern int����MagicNumber = 10042;

extern string TradeComment = "MACD Turbo v2.0a";

int checkorder=1;

int SlipPage;

double Points,SL,TP;

//+------------------------------------------------------------------+

//|������������������������������������������������������������������|

//+------------------------------------------------------------------+

// 4 or 5 Digit Broker Account Recognition

void HandleDigits()

{

����// Automatically Adjusts to Full-Pip and Sub-Pip Accounts

�� if (Digits == 4 || Digits == 2)

���� {

������ SlipPage = Slippage;

������ Points = Point;

���� }

��

�� if (Digits == 5 || Digits == 3)

���� {

������ SlipPage = Slippage*10;

������ Points = Point*10;

���� }

}

//----------------------- PRINT COMMENT FUNCTION

void subPrintDetails()

{

�� string sComment�� = "";

�� string SP�������� = " ----------------------------------------\n";

�� string NL�������� = "\n";

�� string SessionActive,CurrentSpread,spread;

��

�� TradeSession();

�� MaxSpreadFilter();

�� if(Digits == 4 || Digits == 5){spread = DoubleToStr(10000.0 * (Ask - Bid),1);}

�� if(Digits == 2 || Digits == 3){spread = DoubleToStr(100.0 * (Ask - Bid),1);}

�� if (TradeSession())SessionActive = "Trading...";

���� else SessionActive = "Non-Trading Time";

�� if (MaxSpreadFilter())CurrentSpread = " is to High";

���� else CurrentSpread = " is OK";

�� sComment = "MACD Turbo v2.0a" + NL;

�� sComment = sComment + NL;

�� sComment = sComment + "Magic Number " + DoubleToStr(MagicNumber,0) + NL;

�� sComment = sComment + "StopLoss " + DoubleToStr(StopLoss,0) + " | ";

�� sComment = sComment + "TakeProfit " + DoubleToStr(TakeProfit,0) + " | ";

�� sComment = sComment + "TrailingStop " + DoubleToStr(TrailingStop,0) + NL;

�� sComment = sComment + "Date: " + Month() +"-"+Day()+"-"+Year()+" Server Time: " + TimeToStr(TimeCurrent(), TIME_SECONDS) + NL;

�� sComment = sComment + "GMT Time: " + TimeToStr((TimeCurrent()+ (( 0 - ServerTimeZone) * 3600)), TIME_SECONDS) + NL;

�� sComment = sComment + "ServerTimeZone: " + ServerTimeZone + " (TimeZone)" + NL;

�� sComment = sComment + SP;

�� sComment = sComment + "Lot Size " + DoubleToStr(Lots,2) + NL;

�� sComment = sComment + SessionActive + NL;

�� sComment = sComment + "Spread: " + spread + CurrentSpread + NL;

�� Comment(sComment);

}

//+------------------------------------------------------------------+

bool TradeSession() {

�� int HourStartTrade;

�� int HourStopTrade;

�� HourStartTrade = HourStartGMT + ServerTimeZone;

�� HourStopTrade = HourStopGMT + ServerTimeZone;

�� if (HourStartTrade < 0)HourStartTrade = HourStartTrade + 24;

�� if (HourStartTrade >= 24)HourStartTrade = HourStartTrade - 24;

�� if (HourStopTrade > 24)HourStopTrade = HourStopTrade - 24;

�� if (HourStopTrade <= 0)HourStopTrade = HourStopTrade + 24;

�� if ((UseFridayFinalTradeTime && (Hour()>=FridayFinalHourGMT + ServerTimeZone) && DayOfWeek()==5)||DayOfWeek()==0)return (FALSE); // Friday Control

�� if((TimeControl(HourStartTrade,HourStopTrade)!=1 && TimeControl==1 && HourStartTrade<HourStopTrade)

��������|| (TimeControl(HourStopTrade,HourStartTrade)!=0 && TimeControl==1 && HourStartTrade>HourStopTrade)

����������||TimeControl==0)return (TRUE); // "Trading Time";

����return (FALSE); // "Non-Trading Time";

}

//+------------------------------------------------------------------+

int TimeControl(int StartHour, int EndHour)

{

�� if (Hour()>=StartHour && Hour()< EndHour)

������{

������return(0);

������}

return(1);

}

//+------------------------------------------------------------------+

bool MaxSpreadFilter()

��{

�� RefreshRates();

���� if ((Digits == 4 || Digits == 5)&&(10000.0 * (Ask - Bid) > MaxSpread))

������ {return(true);}

���� if ((Digits == 2 || Digits == 3)&&(100.0 * (Ask - Bid) > MaxSpread))

������ {return(true);}

�� else return(false);

��}

��

//+------------------------------------------------------------------+

//|������������������������������������������������������������������|

//+------------------------------------------------------------------+

int start()

{

�� double MacdCurrent, MacdPrevious, SignalCurrent;

�� double SignalPrevious, MaCurrent, MaPrevious;

�� int cnt, ticket, total;

// initial data checks

// it is important to make sure that the expert works with a normal

// chart and the user did not make any mistakes setting external

// variables (Lots, StopLoss, TakeProfit,

// TrailingStop) in our case, we check TakeProfit

// on a chart of less than 100 bars

�� if(Bars<100)

���� {

������Print("bars less than 100");

������return(0);��

���� }

�� if(TakeProfit<10)

���� {

������Print("TakeProfit less than 10");

������return(0);��// check TakeProfit

���� }

// to simplify the coding and speed up access

// data are put into internal variables

�� MacdCurrent=iMACD(NULL,0,12,26,9,PRICE_CLOSE,MODE_MAIN,0);

�� MacdPrevious=iMACD(NULL,0,12,26,9,PRICE_CLOSE,MODE_MAIN,1);

�� SignalCurrent=iMACD(NULL,0,12,26,9,PRICE_CLOSE,MODE_SIGNAL,0);

�� SignalPrevious=iMACD(NULL,0,12,26,9,PRICE_CLOSE,MODE_SIGNAL,1);

�� MaCurrent=iMA(NULL,0,MATrendPeriod,0,MODE_EMA,PRICE_CLOSE,0);

�� MaPrevious=iMA(NULL,0,MATrendPeriod,0,MODE_EMA,PRICE_CLOSE,1);

�� HandleDigits();

�� subPrintDetails();

�� total=OrdersTotal();

��

�� if(checkorder<1)

���� {

������// if no opened orders identified

������if(AccountFreeMargin()<(1000*Lots))

��������{

�������� Print("You dont have enough money. Free Margin = ", AccountFreeMargin());

�������� return(0);

��������}

������// check for long position (BUY) possibility

������if(!MaxSpreadFilter() && MacdCurrent<0 && MacdCurrent>SignalCurrent && MacdPrevious<SignalPrevious &&

�������� MathAbs(MacdCurrent)>(MACDOpenLevel*Points) && MaCurrent>MaPrevious && TradeSession())

��������{

�������� ticket=OrderSend(Symbol(),OP_BUY,Lots,Ask,SlipPage,0,0,TradeComment,MagicNumber,0,Green);

�������� if(ticket>0)

���������� {

������������if(OrderSelect(ticket,SELECT_BY_TICKET,MODE_TRADES))

�������������� {

����������������Print("BUY order opened : ",OrderOpenPrice());

����������������checkorder=checkorder+1;

�������������� }

���������� }

�������� else Print("Error opening BUY order : ",GetLastError());

�������� return(0);

��������}

������// check for short position (SELL) possibility

������if(!MaxSpreadFilter() && MacdCurrent>0 && MacdCurrent<SignalCurrent && MacdPrevious>SignalPrevious &&

�������� MacdCurrent>(MACDOpenLevel*Points) && MaCurrent<MaPrevious && TradeSession())

��������{

�������� ticket=OrderSend(Symbol(),OP_SELL,Lots,Bid,SlipPage,0,0,TradeComment,MagicNumber,0,Red);

�������� if(ticket>0)

���������� {

������������if(OrderSelect(ticket,SELECT_BY_TICKET,MODE_TRADES))

�������������� {

����������������Print("SELL order opened : ",OrderOpenPrice());

����������������checkorder=checkorder+1;

�������������� }

���������� }

�������� else Print("Error opening SELL order : ",GetLastError());

�������� return(0);

��������}

������return(0);

���� }

�� // it is important to enter the market correctly,

�� // but it is more important to exit it correctly...

if(checkorder>0)

��{

�� checkorder=0;

�� for(cnt=0;cnt<total;cnt++)

���� {

������OrderSelect(cnt, SELECT_BY_POS, MODE_TRADES);

������if(OrderSymbol()==Symbol()&& // check for symbol

�������� OrderMagicNumber()==MagicNumber) // check the Magic Number

��������{

�������� if(OrderType()==OP_BUY) // go to long position

���������� {

������������checkorder=checkorder+1;

������������// check for trailing stop

������������if(TrailingStop>0)

��������������{

�������������� if(Bid-OrderOpenPrice()>Points*TrailingStop)

���������������� {

������������������if(OrderStopLoss()<Bid-Points*(TrailingStop+TrailingStep))

��������������������{

�������������������� OrderModify(OrderTicket(),OrderOpenPrice(),Bid-Points*TrailingStop,OrderTakeProfit(),0,Green);

�������������������� return(0);

��������������������}

���������������� }

��������������}

������������// modify OrderStopLoss and OrderTakeProfit for Buy

������������if(OrderStopLoss()==0 && OrderTakeProfit()==0 && (StopLoss>0||TakeProfit>0))

��������������{

�������������� SL = OrderStopLoss();

�������������� if (StopLoss>0) {SL =(OrderOpenPrice() - (StopLoss*Points));}

�������������� TP = OrderTakeProfit();

�������������� if (TakeProfit>0) {TP =(OrderOpenPrice() + (TakeProfit*Points));}

�������������� OrderModify(OrderTicket(),OrderOpenPrice(),SL,TP,0,Green);

�������������� return(0);

��������������}

���������� }

�������� if(OrderType()==OP_SELL) // go to short position

���������� {

������������checkorder=checkorder+1;

������������// check for trailing stop

������������if(TrailingStop>0)

��������������{

�������������� if((OrderOpenPrice()-Ask)>(Points*TrailingStop))

���������������� {

������������������if((OrderStopLoss()>(Ask+Points*(TrailingStop+TrailingStep))) || (OrderStopLoss()==0))

��������������������{

�������������������� OrderModify(OrderTicket(),OrderOpenPrice(),Ask+Points*TrailingStop,OrderTakeProfit(),0,Red);

�������������������� return(0);

��������������������}

���������������� }

��������������}

������������// modify OrderStopLoss and OrderTakeProfit for Sell

������������if(OrderStopLoss()==0 && OrderTakeProfit()==0 && (StopLoss>0||TakeProfit>0))

��������������{

�������������� SL = OrderStopLoss();

�������������� if (StopLoss>0) {SL =(OrderOpenPrice() + (StopLoss*Points));}

�������������� TP = OrderTakeProfit();

�������������� if (TakeProfit>0) {TP =(OrderOpenPrice() - (TakeProfit*Points));}

�������������� OrderModify(OrderTicket(),OrderOpenPrice(),SL,TP,0,Red);

�������������� return(0);

��������������}

���������� }

��������}

���� }

�� }

�� return(0);

��}

// the end.

Lets see if I can finish today but if anyone else manages to translate it before me, you are welcome to post the code so I can compare it to my final translation.

|

|

|

Re: My Take on A Mega Script

[Re: ]

#435189

Re: My Take on A Mega Script

[Re: ]

#435189

01/03/14 19:31

01/03/14 19:31

|

liftoff

Unregistered

|

liftoff

Unregistered

|

So I did a little reading and copy and pasting gets me what I think is the zorro version of this mt4 strategy. Based on my understanding and testing it turned out to be unprofitable based on the raw code and parameters.

function hourOpen(int hourblockstart, int hourblockend)

{

//blocks new trades between selected hours

//uses NYSE time, including DST

if ( (lhour(ET) >= hourblockstart) && (lhour(ET) < hourblockend) )

return 0; //between blocked hours, do not allow trade opens

else

return 1; //no conditions met, allow trades by default

}

function fridayCloseTrading(int fridayfinalhourET)

{

//blocks new open trades on fridays from the hour set

// uses NYSE time, including DST

if (ldow(ET) == FRIDAY && (lhour(ET)>= fridayfinalhourET))

return 0; // during the no new trade friday period.

else

return 1; // no condition met, allow new trades by default

}

function run()

{

StartDate = 2002;

EndDate = 20131231;

BarPeriod = 60;

LookBack = 250;

//edge trading logic

int FastPeriod = 12;

int SlowPeriod = 26;

int SignalPeriod = 9;

int MACDOpenLevel = 3;

int MACDCloseLevel= 2;

int MATrendPeriod=24;

int OpenOrders = 2;

int hourblockend = 3;

int hourblockstart = 14;

int fridayfinalhourET = 1;

vars PriceClose = series(priceClose());

MACD(PriceClose,FastPeriod,SlowPeriod,SignalPeriod);

vars MainLine = series(rMACD);

vars SignalLine = series(rMACDSignal);

vars MA1 = series(EMA(PriceClose,MATrendPeriod));

Stop = 255*PIP; // ATR(200)*5;

Trail = 25*PIP; // ATR(200)*5;

TakeProfit = 100*PIP;

if(hourOpen(hourblockend,hourblockstart) && fridayCloseTrading(fridayfinalhourET)){

if(NumOpenTotal<OpenOrders && MainLine[0]<0 && crossOver(MainLine,SignalLine) && (-1*MainLine[0])>(0.0001*MACDOpenLevel) && rising(MA1))

reverseLong(1);

else if(NumOpenTotal<OpenOrders && MainLine[0]>0 && crossUnder(MainLine,SignalLine) && MainLine[0]>(0.0001*MACDOpenLevel) && falling(MA1))

reverseShort(1);

}

// plot("MainLine", MainLine[0], NEW, BLUE);

// plot("SignalLine", SignalLine[0], 0, RED);

// plot("TrendLine", MA1[0], NEW, BLACK);

}

I will go through changing some parameters tomorrow and see how it fares.

|

|

|

Re: My Take on A Mega Script

[Re: ]

#435232

Re: My Take on A Mega Script

[Re: ]

#435232

01/04/14 10:12

01/04/14 10:12

|

liftoff

Unregistered

|

liftoff

Unregistered

|

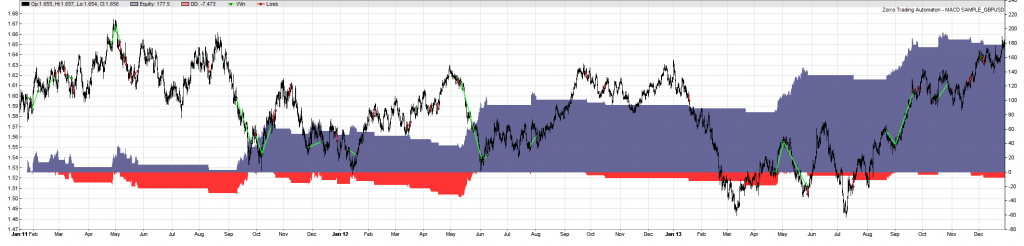

So I just changed the stops to more adaptive stops and took out the trailing stop. Set the parameter flag and trained. It now seems to be more profitable as it has been "curve fitted". This is the code I ended up with, the original EA was built for GBPUSD. It is one of the few trend following systems I have seen that might have pulled a profit in 2013. I think it has potential and I will comeback to taking it through the evaluation process once I am done with all the recommended books.

function hourOpen(int hourblockstart, int hourblockend)

{

//blocks new trades between selected hours

//uses NYSE time, including DST

if ( (lhour(ET) >= hourblockstart) && (lhour(ET) < hourblockend) )

return 0; //between blocked hours, do not allow trade opens

else

return 1; //no conditions met, allow trades by default

}

function fridayCloseTrading(int fridayfinalhourET)

{

//blocks new open trades on fridays from the hour set

// uses NYSE time, including DST

if (ldow(ET) == FRIDAY && (lhour(ET)>= fridayfinalhourET))

return 0; // during the no new trade friday period.

else

return 1; // no condition met, allow new trades by default

}

function run()

{

set(PARAMETERS);

StartDate = 2011;

EndDate = 2013;

BarPeriod = 60;

LookBack = 250;

//edge trading logic

int FastPeriod = 12;

int SlowPeriod = 26;

int SignalPeriod = 9;

int MACDOpenLevel = 3;

int MACDCloseLevel= 2;

int MATrendPeriod=24;

int OpenOrders = 2;

int hourblockend = 3;

int hourblockstart = 14;

int fridayfinalhourET = 1;

vars PriceClose = series(priceClose());

MACD(PriceClose,FastPeriod,SlowPeriod,SignalPeriod);

vars MainLine = series(rMACD);

vars SignalLine = series(rMACDSignal);

vars MA1 = series(EMA(PriceClose,MATrendPeriod));

Stop = ATR(200)*optimize(3,1,10,1); //Adaptive Stop

Trail = ATR(200)*optimize(5,1,10,1); //Adaptive Trail

// TakeProfit = 100*PIP;

if(hourOpen(hourblockend,hourblockstart) && fridayCloseTrading(fridayfinalhourET)){

if(NumOpenTotal<OpenOrders && MainLine[0]<0 && crossOver(MainLine,SignalLine) && (-1*MainLine[0])>(0.0001*MACDOpenLevel) && rising(MA1))

reverseLong(1);

else if(NumOpenTotal<OpenOrders && MainLine[0]>0 && crossUnder(MainLine,SignalLine) && MainLine[0]>(0.0001*MACDOpenLevel) && falling(MA1))

reverseShort(1);

}

// plot("MainLine", MainLine[0], NEW, BLUE);

// plot("SignalLine", SignalLine[0], 0, RED);

// plot("TrendLine", MA1[0], NEW, BLACK);

}

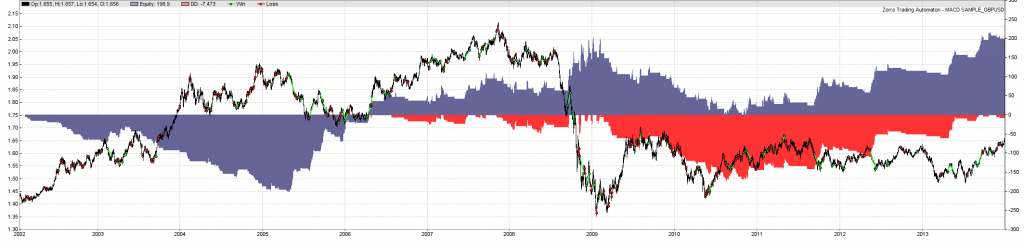

MACD SAMPLE compiling................

BackTest: MACD SAMPLE GBP/USD 2002..2013

Profit 199$ MI 1$ DD 202$ Capital 108$

Trades 238 Win 35% Avg +11.0p Bars 70

AR 16% PF 1.20 SR 0.27 UI 51.9% Error 40%

Everyone is welcome to use it as they wish. We are in this together. Here is the 2002-2013 growth curve.  This is the 2011-2013 growth curve.

|

|

|

Re: My Take on A Mega Script

[Re: ]

#435239

Re: My Take on A Mega Script

[Re: ]

#435239

01/04/14 14:17

01/04/14 14:17

|

liftoff

Unregistered

|

liftoff

Unregistered

|

A lot of free time on my hands today so I might as well try out some simple strategy translations. I will be looking at PZ Reversal Trend Following EA. System Description:

Trend following systems can vary, but principle elements remain the same. A reversal system, a very common system, has two modes: you are either long or short. It is always in the market and closes one position by opening a new one in the opposite direction.

With this MT4 Expert Advisor, you can either be long or short at any given time. You enter a long position and exit a short position if the current price closes above the highest price in the previous 100 days. You enter a short position and exit a long position if the current price drops below the lowest price in the previous 100 days.

This system should be applied to a huge variety of instruments to make sure to catch some big trends to pay for the other little losses. You should trade forex, commodities, indexes, interest rates, government bonds and even sectorial stocks. As a sidenote, Bill Dunn is a long term reversal trend follower that exploited the Japanese Yen to extreme levels in 1995 with a reversal system exactly like this one and has reaped incredible profits since then.

The MT4 code read as follows.

//+------------------------------------------------------------------+

//| PZ_ReversalTrendFollowingEA.mq4

//| --

//| You can either be long or short at any given time. You buy if the market

//| makes a new 100-day high and sell if the market makes a new 100-day low.

//| You are always in the market and break-even all trades as soon as possible.

//+------------------------------------------------------------------+

#property copyright "Copyright � http://www.pointzero-trading.com"

#property link "http://www.pointzero-trading.com"

//---- Dependencies

#import "stdlib.ex4"

string ErrorDescription(int e);

#import

//---- Constants

#define ShortName "PZ Reversal Trend Following EA"

#define Shift 1

//---- External variables

extern string TR_Ex = "------- Trade period";

extern int TradingPeriod = 100;

extern string MM_Ex = "------- Money management";

extern bool MoneyManagement = true;

extern double RiskPercent = 2;

extern double LotSize = 0.1;

extern string EA_Ex = "------- EA Settings";

extern int Slippage = 6;

extern int MagicNumber = 2000;

//---- Internal

double DecimalPip;

double PBuy = EMPTY_VALUE;

double PSell = EMPTY_VALUE;

//+------------------------------------------------------------------+

//| Custom EA initialization function

//+------------------------------------------------------------------+

int init()

{

DecimalPip = GetDecimalPip();

Comment("Copyright � http://www.pointzero-trading.com");

return(0);

}

//+------------------------------------------------------------------+

//| Custom EA deinit function

//+------------------------------------------------------------------+

int deinit()

{

return(0);

}

//+------------------------------------------------------------------+

//| Custom EA start function

//+------------------------------------------------------------------+

int start()

{

//--

//-- Trade if trigger price is breached

//--

// Buy

if(PBuy != EMPTY_VALUE && Bid > PBuy)

{

PlaceOrder(OP_BUY, GetLotSize());

PBuy = EMPTY_VALUE;

}

// Sell

if(PSell != EMPTY_VALUE && Ask < PSell)

{

PlaceOrder(OP_SELL, GetLotSize());

PSell = EMPTY_VALUE;

}

//--

//-- Check entry

//--

// Do not continue unless the bar is closed

if(!IsBarClosed(0, true)) return(0);

// Trading thresholds

double rhigh = iHigh(Symbol(), Period(), iHighest(Symbol(), Period(), MODE_HIGH, TradingPeriod, Shift+1));

double rlow = iLow(Symbol(), Period(), iLowest(Symbol(), Period(), MODE_LOW, TradingPeriod, Shift+1));

// Trades opened

int l_TotalTrades_buy = GetTotalTrades(OP_BUY, MagicNumber);

int l_TotalTrades_sell = GetTotalTrades(OP_SELL, MagicNumber);

// Bars

double CLOSE = iClose(Symbol(),0, Shift);

double HIGH = iHigh(Symbol(),0, Shift);

double LOW = iLow(Symbol(),0, Shift);

// Check if buy conditions apply

if(CLOSE > rhigh && l_TotalTrades_buy == 0)

{

// Buy

PBuy = HIGH;

CloseOrder(OP_SELL);

}

// Check if sell conditions apply

if(CLOSE < rlow && l_TotalTrades_sell == 0)

{

// Sell

PSell = LOW;

CloseOrder(OP_BUY);

}

return (0);

}

//+------------------------------------------------------------------+

//| My functions

//+------------------------------------------------------------------+

/**

* Returns total opened trades

* @param int Type

* @param int Magic

* @return int

*/

int GetTotalTrades(int Type, int Magic)

{

int counter = 0;

for (int i = OrdersTotal() - 1; i >= 0; i--)

{

if (!OrderSelect(i, SELECT_BY_POS, MODE_TRADES))

{

Print(ShortName +" (OrderSelect Error) "+ ErrorDescription(GetLastError()));

} else if(OrderSymbol() == Symbol() && (OrderType() == Type || Type == EMPTY_VALUE) && OrderMagicNumber() == Magic) {

counter++;

}

}

return(counter);

}

/**

* Places an order

* @param int Type

* @param double Lotz

* @param double PendingPrice

*/

void PlaceOrder(int Type, double Lotz, double PendingPrice = 0)

{

int err;

color l_color;

double l_price, l_sprice = 0;

RefreshRates();

// Price and color for the trade type

if(Type == OP_BUY){ l_price = Ask; l_color = Blue; }

if(Type == OP_SELL){ l_price = Bid; l_color = Red; }

// Avoid collusions

while (IsTradeContextBusy()) Sleep(1000);

int l_datetime = TimeCurrent();

// Send order

int l_ticket = OrderSend(Symbol(), Type, Lotz, l_price, Slippage, 0, 0, "", MagicNumber, 0, l_color);

// Rety if failure

if (l_ticket == -1)

{

while(l_ticket == -1 && TimeCurrent() - l_datetime < 60 && !IsTesting())

{

err = GetLastError();

if (err == 148) return;

Sleep(1000);

while (IsTradeContextBusy()) Sleep(1000);

RefreshRates();

l_ticket = OrderSend(Symbol(), Type, Lotz, l_price, Slippage, 0, 0, "", MagicNumber, 0, l_color);

}

if (l_ticket == -1)

Print(ShortName +" (OrderSend Error) "+ ErrorDescription(GetLastError()));

}

}

/**

* Closes desired orders

* @param int Type

*/

void CloseOrder(int Type)

{

int l_type;

for(int i = OrdersTotal()-1; i >= 0; i--)

{

OrderSelect(i, SELECT_BY_POS, MODE_TRADES); l_type = OrderType();

if(OrderSymbol() == Symbol() && OrderMagicNumber() == MagicNumber && Type == l_type)

{

if(Type == OP_BUY || Type == OP_SELL)

{

if(!OrderClose(OrderTicket(), OrderLots(), OrderClosePrice(), Slippage, Gold))

Print(ShortName +" (OrderClose Error) "+ ErrorDescription(GetLastError()));

} else {

if(!OrderDelete(OrderTicket()))

Print(ShortName +" (OrderDelete Error) "+ ErrorDescription(GetLastError()));

}

}

}

}

/**

* Calculates lot size according to risk and the weight of this trade

* @return double

*/

double GetLotSize()

{

// Lots

double l_lotz = LotSize;

// Lotsize and restrictions

double l_minlot = MarketInfo(Symbol(), MODE_MINLOT);

double l_maxlot = MarketInfo(Symbol(), MODE_MAXLOT);

double l_lotstep = MarketInfo(Symbol(), MODE_LOTSTEP);

int vp = 0; if(l_lotstep == 0.01) vp = 2; else vp = 1;

// Apply money management

if(MoneyManagement == true)

l_lotz = MathFloor(AccountBalance() * RiskPercent / 100.0) / 1000.0;

// Normalize to lotstep

l_lotz = NormalizeDouble(l_lotz, vp);

// Check max/minlot here

if (l_lotz < l_minlot) l_lotz = l_minlot;

if(l_lotz > l_maxlot) l_lotz = l_maxlot;

// Bye!

return (l_lotz);

}

/**

* Returns decimal pip value

* @return double

*/

double GetDecimalPip()

{

switch(Digits)

{

case 5: return(0.0001);

case 4: return(0.0001);

case 3: return(0.001);

default: return(0.01);

}

}

/**

* Checks if the bar has closed

*/

bool IsBarClosed(int timeframe,bool reset)

{

static datetime lastbartime;

if(timeframe==-1)

{

if(reset)

lastbartime=0;

else

lastbartime=iTime(NULL,timeframe,0);

return(true);

}

if(iTime(NULL,timeframe,0)==lastbartime) // wait for new bar

return(false);

if(reset)

lastbartime=iTime(NULL,timeframe,0);

return(true);

}

So I crawl back into my cave to see how well I can read and translate this code.

|

|

|

|