No, but they look interesting at a first glance. Problem is that when you read one system development book, such as the Jaekle & Tomasini, you probably won't learn much new from the other books unless they introduce some revolutionary new ideas.

Hyperfish: I believe your code is missing an additional entry condition from the original system, that's why you're getting worse results than in the book. This was my script which reproduces the book result:

function run()

{

StartDate = 20021021;

EndDate = 20080704;

BarPeriod = 30;

LookBack = 30;

set(TICKS|PLOTNOW);

PlotWidth = 800;

asset("GBP/USD");

// no commissions...

Spread = 0;

Slippage = 0;

RollLong = RollShort = 0;

vars Price = series(priceClose()),

Fast = series(SMA(Price,3)),

Slow = series(SMA(Price,30));

static var BuyLimit,SellLimit,BuyStop,SellStop;

if(crossOver(Fast,Slow)) {

BuyStop = priceHigh() + 1*PIP;

BuyLimit = priceHigh() + 5*PIP;

}

if(crossUnder(Fast,Slow)) {

SellStop = priceLow() - 1*PIP;

SellLimit = priceLow() - 5*PIP;

}

if(!NumOpenLong && Fast[0] > Slow[0] && Price[0] < BuyLimit)

enterLong(1,BuyStop);

if(!NumOpenShort && Fast[0] < Slow[0] && Price[0] > SellLimit)

enterShort(1,SellStop);

}

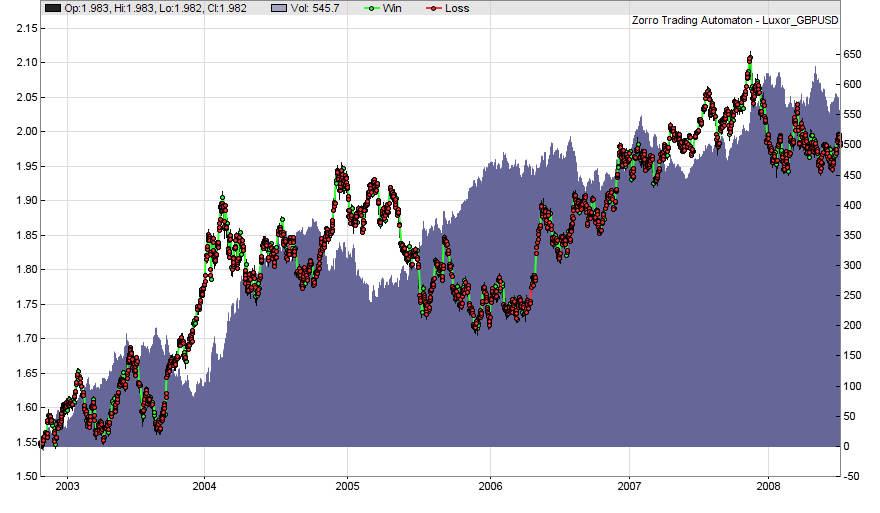

The result:

And you're also right with 3). Systems with time frames below one hour can become very feed dependent. Although the Luxor system result is reproducible, short timeframe results normally can't be reproduced well with price data from other sources. This does not mean that some feed has 'better quality' than the other, it's just the way how price data is sampled. Forex prices depend on the liquidity providers that are currently used by the broker. So a system that uses short timeframes becomes very fragile, and its results are normally not valid for different market situations or for different liquidity providers.